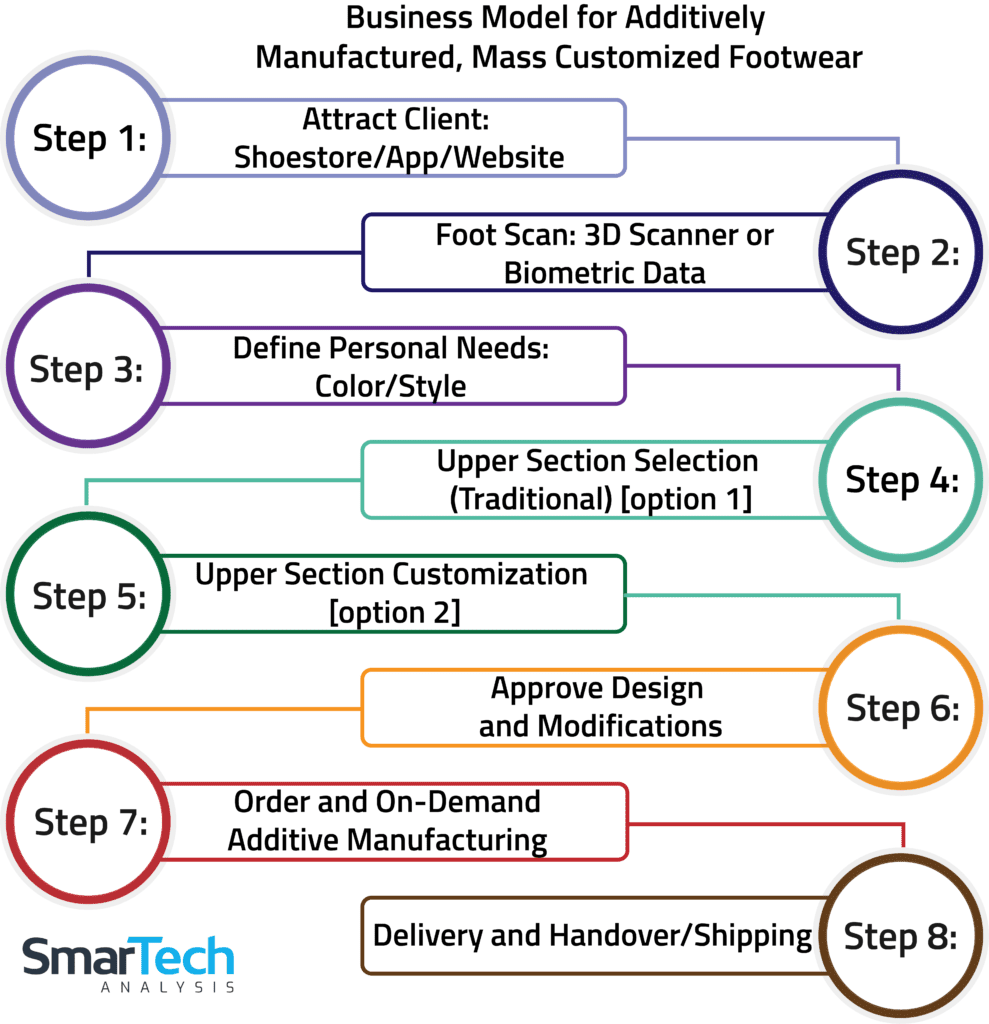

Business Model for Additively Manufactured, Mass Customized Footwear

Projected Refractory Metal Based AM Powder Shipment Growth Rates, By Metal

Projected Refractory Metal Based AM Powder Shipment Growth Rates, By Metal, 2014-2027 From SmarTech Analysis Refractory Metal Report

Continue readingTotal Projected Titanium AM Powder Consumption by Print Technology Family

Total Projected Titanium AM Powder Consumption by Print Technology Family, Global, 2014-2027(e) From SmarTech Titanium AM Report

Continue readingTen-Year Forecasts of Materials Consumed by Metals Service Bureaus

Ten-Year Forecasts of Materials Consumed by Metals Service Bureaus ($Millions) From SmarTech Analysis Metals Service Bureau Report

Continue readingAnnual Dental 3D Printing Revenue Growth by Segment, 2016-2028

Annual Dental 3D Printing Revenue Growth by Segment, 2016-2028 from SmarTech’s 3D Printing in Dentistry Report

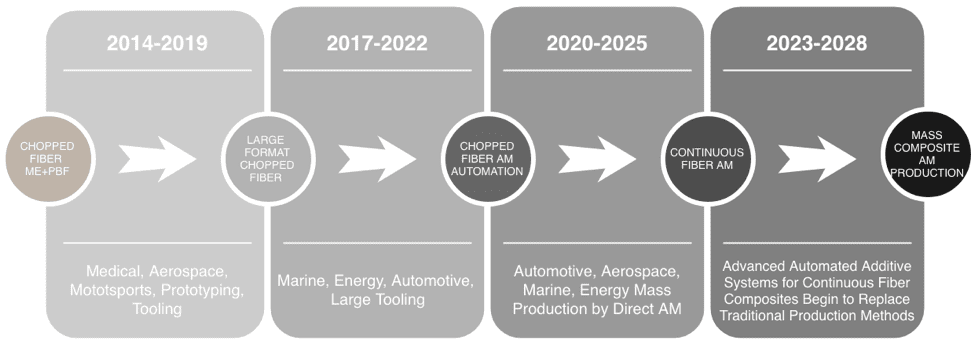

Continue readingTimeline for Adoption of Composite Additive Manufacturing

Long-term growth for composite additive manufacturing is expected to be very significant as composites become even more relevant in segments that expand beyond the medical and aerospace sectors and into consumer areas such as next generation automotive, energy, and transportation in general. As composite additive manufacturing technologies are perfected, SmarTech Publishing expects that they will take up a very considerable share of the entire composite manufacturing market.

Composites Report:

Share of Refractory Metal AM Application Revenues, by Industry, 2014-2027

Share of Refractory Metal AM Application Revenues, by Industry, 2014-2027

Through the next ten years, SmarTech believes that refractory metals will be the fastest growing class of metals in powder-based additive manufacturing markets, exceeding even that of aluminum alloys and other specialty materials, growing at a combined 46 percent compounded annually in terms of the consumption of refractory based materials. At this stage in the market’s development, medical applications are expected to dominate the use of AM to produce refractory metal finished parts, though a wide swath of other potential applications exist which will require dedicated solution development.

Projected Refractory Metal Based AM Powder Shipment Growth Rates, by Metal, 2014-2027

SmarTech Publishing sees Additive Manufacturing technology as a potentially disruptive processing method for tungsten, tantalum, niobium, and molybdenum materials, which will unlock new worldwide potential for producing components constructed from refractory metals. SmarTech’s latest report sees market growth of almost 45 percent compounded annually through 2027.

https://additivemanufacturingresearch.com/reports/additive-manufacturing-refractory-metals/

Total Automotive Additive Manufacturing Hardware Revenue ($millions)

Automotive additive manufacturing hardware revenue To Reach $1.3 billion in 2023 and will grow to $3 billion in 2028