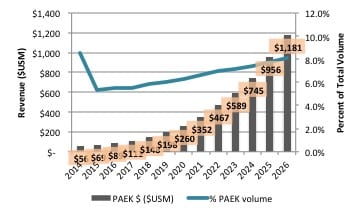

In the latest Opportunities in Polymer and Plastic 3D Printing – 2017: An Opportunity Analysis and Ten-Year Forecast report, SmarTech Publishing focuses on the material category of “advanced thermoplastics” which are primarily those in the polyaryletherketone (PAEK) family, including PEEK and PEKK. This category also includes the polyetherimide family (ULTEM) used today primarily by Stratasys’ closed materials systems. Based on growing use in powder bed fusion processes and a number of newly developed open materials-based extrusion systems, SmarTech Publishing identifies and details the significant business opportunities for PAEK polymers over the next decade, as are expected to account for nearly 19 percent of total polymer 3D print material revenues by 2026, while representing just over 8 percent of total projected print material volume from professional and industrial polymer 3D printers.

Captions: despite accounting for just over 8 percent of demand in 2026, PAEK family advanced thermopolymers are expected to become the most profitable segment, from over $1.1 billion in generated revenues

Very recently, startup vendors have begun designing quality extrusion systems at a lower price point that are focusing on processing advanced thermoplastics in filament form, mostly PEEK. Developers of these printers and materials include Roboze (Italy) and INDMATEC (Germany).

PAEK Applications Start with Powder Bed Fusion

SmarTech Publishing has identified several elements that suggest increased PAEK adoption especially in SLS processes

# 1. Leading manufacturer EOS is already offering PEEK for SLS. PAEK family polymers are 3D printable in material extrusion but currently used primarily in powder bed fusion processes. Leading SLS system manufacturer EOS offers its own certified PEEK material (developed with Rauch), making it the only current provider of a readily approved advanced thermoplastic powder for its own technology.

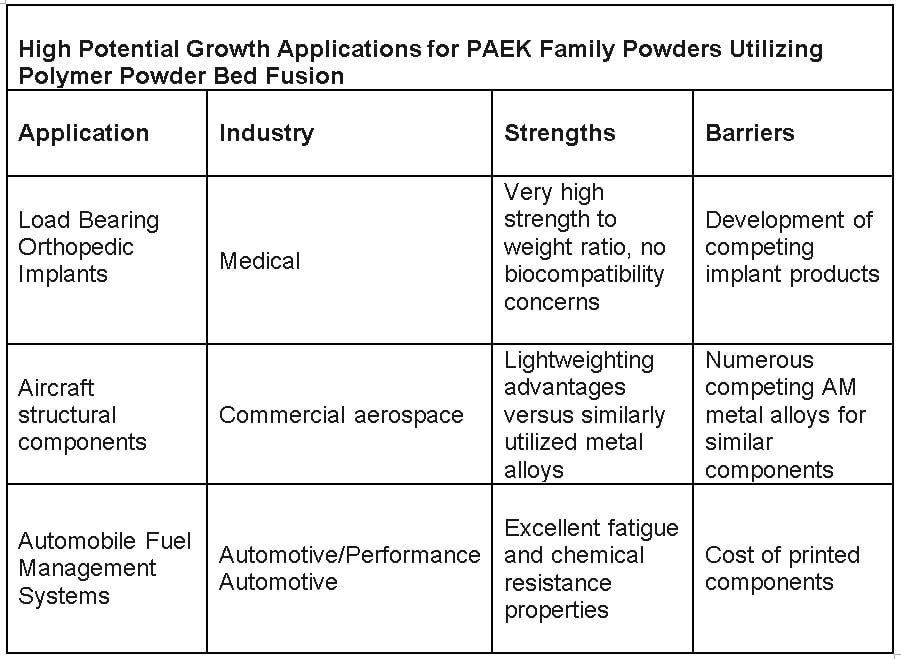

# 2. PAEK family polymers are used in high-cost industries. Adoption of these materials is driven by demand of very high performance components, combining high strength, lightweight materials and advanced geometries possible through AM. Currently, the aerospace and medical industries are leading the way in 3D printing of advanced thermoplastic powders utilizing SLS, although growth in energy, defense, and sectors is expected.

# 3. PEKK 3D printed medical implants are now load bearing capable SmarTech Publishing expects growth in the area of medical implants made of PEKK and PEEK, as the load bearing capabilities of printed PEKK parts through laser sintering has now been achieved with Oxford Performance Materials’ SpineFab implant. While titanium alloy has been the leader in printed orthopedic implants for nearly a decade, titanium implants may lose some competitive advantage should costs of titanium powder remain high — recent studies have shown promising results in the ability of PEKK implants to achieve appropriate load bearing strength for orthopedic implants, while remaining lighter overall.

Captions: Exhibit details potential growth areas in PAEK powder printing utilizing current polymer powder bed fusion technology.

Credits: SmarTech Publishing

Taking a PEEK at Future Markets for Extrusion

SmarTech Publishing’s Polymer report goes on to detail PEEK and PEKK will partially and gradually replace ULTEM, which currently accounts for the vast majority of revenues generated from advanced thermoplastic print materials. As ULTEM currently exorbitant prices decrease, PEEK/PEKK adoption rates in extrusion technology are likely to increase due to the increased presence of material extrusion systems, outside of those provided by Stratasys, that are beginning to become commercially available.

The Roboze One+400 printer, announced by Italian printer manufacturer Roboze in November 2015, is claimed to be able to achieve 400 degrees Celsius in the extruder, allowing for printing of both of PEEK and PEI filaments. Roboze developed a special cooling system to stabilize the material and avoid warping issues at these elevated extrusion temperatures, without breaching Stratasys’ sealed chamber patent. Meanwhile, German company INDMATEC announced in 2015 what is perhaps the first PEEK filament available for 3D printers, to use in a compatible system which is expected to be priced at around $40,000 when it will become fully available on the market.

With availability opening up for advanced thermoplastic materials in both material extrusion and polymer powder bed fusion, the catalyst for growth in demand for these materials will revolve around development of specific applications for advanced materials. These applications will be intrinsically linked to replacement of existing metal structures or components in very high performance products or industries. Thus, advanced thermoplastic materials will rely heavily on the acceptance of 3D printing as a manufacturing tool.

Another pivotal factor in the market for PAEK materials is whether or not they will be able to be reliably processed (as strongly hinted) by the incoming generation of thermal-based powder bed fusion systems, such as those from Hewlett Packard. With laser sintering properties of materials such as PEKK having spent over five years in development through various commercial entities, it may be some time before advanced thermoplastic powders become usable for alternate powder bed fusion approaches (if at all). Once that happens the market is likely to undergo a very significant shift.

About SmarTech Publishing’s 3DP Polymer Opportunities Report

Opportunities in Polymer and Plastic 3D Printing – 2017 is the third generation of the world’s most comprehensive analysis of polymer 3D printing technology. In this new edition, market analysis is segmented by print technology market -as each major polymer print process settles into its own roles and established applications, our analysis has deepened to the specifics of each driving print technology and associated materials.

Utilizing purpose-built proprietary 3D printing market models, SmarTech Publishing is able to present detailed market forecast data on thermoplastic filaments, powders, photopolymers, composites, and more utilized in popular print technologies of material extrusion (FDM, FFF), polymer powder bed fusion (SLS, Multi Jet Fusion), photopolymerization (SLA, DLP, CLIP), binder jetting, and more.

All available materials for primary polymer print technologies are analyzed and forecasted, including market revenues as well as material shipments, by industry and geography, over the next decade. Therefore, SmarTech Publishing believes that Opportunities in Polymer and Plastic 3D Printing – 2017 will provide exceptional value to business development professionals and internal market strategy teams for the global chemical and polymer industries, as well as polymer 3D printer manufacturers, print service providers, and developers of polymer 3D printing manufacturing solutions.

For information and to purchase this report:

Missy Wade

missy@smartechpublishing.com

Press Contact:

Lawrence Gasman

lawrence@smartechpublishing.com

434-872-0450