Crozet, VA: SmarTech Analysis has just issued a new report titled, “Market Opportunities for Directed Energy Deposition Manufacturing,” that projects the market for Direct Energy Deposition (DED) machines and related materials will reach almost $755 million (USD) by 2025. Of this amount, materials will account for $265 million in 2025. The report is the next in a series of reports from SmarTech on metal additive manufacturing technologies.

Additional details about the report are available at: https://additivemanufacturingresearch.com/reports/market-opportunities-for-directed-energy-deposition-manufacturing/

About the report:

This new SmarTech Analysis report identifies all the opportunities presented by Directed Energy Deposition (DED) manufacturing technology and its variants such as LMD, LENS, and WAAM. In the report the firm shows where the addressable markets for DED machines are to be found – and where they fit into the additive manufacturing (AM) business relative to other AM processes. End user sectors for DED considered in this report include aerospace, automotive, medical, service bureaus, general industry and tooling, oil & gas and energy. The report also analyzes the market for materials used in DED machines. Metals covered include titanium, steels, nickel alloys, aluminum, cobalt chrome, and refractory materials. The report also examines some of the more unusual feedstocks for DED machines such as polymers and ceramics.

This SmarTech report on the DED market also explains the pricing strategies appropriate to the DED sector. And, it examines both powder-based and wire-based DED and DED-based hybrids. In addition, the report examines in-depth the evolution of DED technology in terms heat sources, print speeds, processing chambers and power supplies.

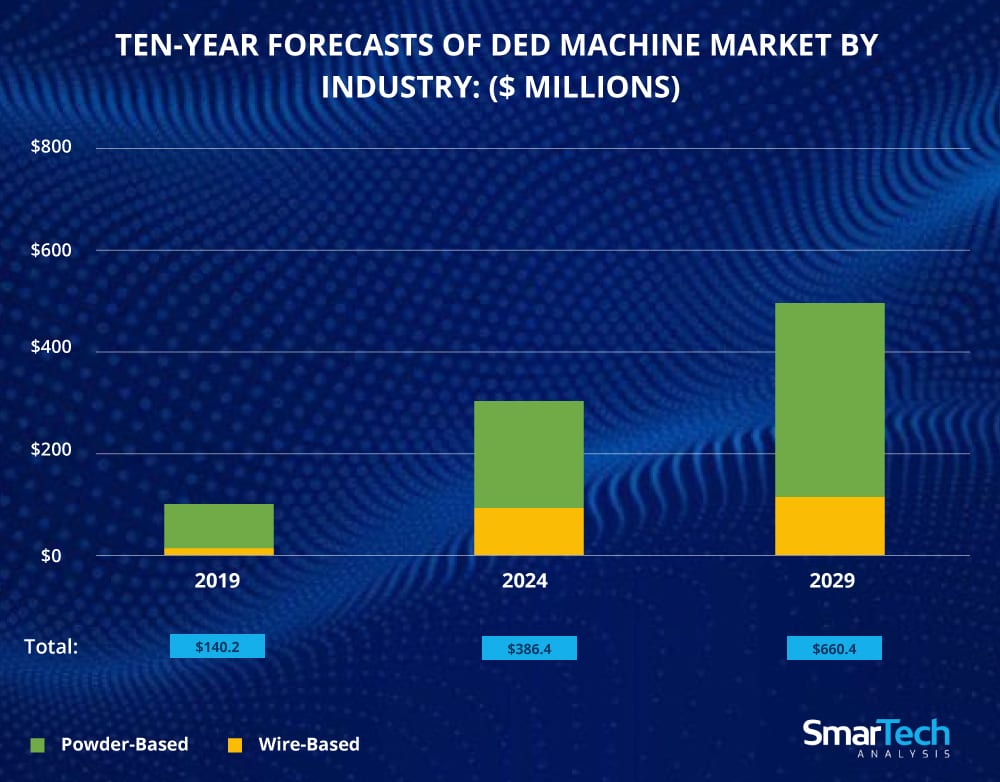

The main part of report provides a highly granular ten-year forecast of all DED-related market segments. These include the machines themselves as well as the materials broken out by material type. In addition, we include breakouts of machines by end-user industry, and projections wire versus powder, and hybrid versus “pure” DED. Both volume and value projections are included for all the forecasts.

Finally, this report includes profiles of the DED strategies of 22 companies. These comprise 3D Hybrid Solutions, Additec, Arevo, BeAM, DM3D, DMG Mori, ELB-Schliff, Evobeam, FormAlloy, InssTek, Hybrid Manufacturing Technologies, Lincoln Electric, Mazak, Okuma, OR Laser/Coherent, Prima Additive, Norsk Titanium, Optomec, Relativity, Sciaky and Trumpf.

From the report:

DED machines are more than just another AM process. DED is a way to automate traditional manual welding processes. This expands the market for DED well beyond those that are considered appropriate by more conventional AM processes. DED is already fairly widely used to repair military equipment and has also been used extensively to repair turbine blades, satellites and other high-end equipment. For larger welding operations, DED provides better control and repeatability than the traditional approach

New applications are being found for DED. Two industries sectors currently dominate the DED end-user base; aerospace and service providers, but others are catching up. This year we expect almost 50 percent of DED revenues come from aerospace and service providers. Yet, this proportion will have dropped to around 40 percent by 2025 as other sectors, especially automotive, energy and oil and gas, discover the advantages of DED

DED uses simple, easily obtained materials and this helps to drive the market. Unlike other AM processes, DED machines use commercial off-the- shelf (COTS) materials, which were originally intended to be used for welding or industrial powder metallurgy. DED can typically print just about any weldable material. DED-based processing will consume $560 million in materials by 2029.