This new blog that examines additive manufacturing of orthopedic implants is drawn from new report, Additive Manufacturing In Orthopedics: Markets for 3D Printed Medical Implants 2019

Looking at market opportunities for additive manufacturing and 3D printing technology, it’s common in today’s world to focus on what’s just on the horizon –those areas where AM/3DP is just beginning to have an impact and shaking up product design, supply chains, business models, and manufacturing implementations. However, it’s also necessary to look at those areas where AM is already a more mature technology (relatively speaking). The areas that often ‘pay the bills’ for stakeholders in the broader AM ecosystem.

One such area is in the additive manufacturing of orthopedic implants. For the sake of exploration, let’s use a more specific definition –in the additive manufacturing of implants for orthopedic applications, defined as those medical devices which are otherwise permanently implanted into the body to correct deformities of bone or muscle. At SmarTech, we like to call this particular segment ‘additive orthopedics.’

In the additive orthopedic market today, AM/3DP technologies have advanced into a new evolution of use, where the focus and industry conversations and related conferences have shifted from those of ‘what is theoretically possible in the future’ to ‘what is economically feasible today with the current solutions and supply chain.’ This shift is the hallmark of a technology moving into a new stage of mainstream relevance, and if one examines headlines and articles in popular trade press outlets for orthopedic business, it’s clear that AM/3DP is, indeed, a mainstream concept.

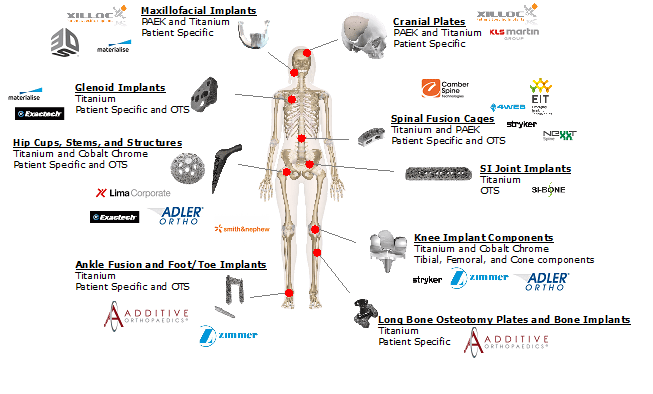

A necessary step in becoming a mainstream force in any industry that AM might disrupt is developing key business cases for application of printed components or parts –in essence, not just talking about AM’s possibilities, nor just producing pre-production parts that are not yet subject to economic constraints. Real rubber-meets-the-road business cases for real parts that will be fielded and used in the real world. Along these lines, the business cases in additive orthopedics continue to expand, and now cover the entirety of the traditional orthopedics industry structure ranging from major joint replacement to trauma solutions. The graphic below provides a visualization of business cases across the industry today.

Source: SmarTech Analysis

Over the last two years, there has been some very compelling movement forward in the orthopedic industry in two important ways. First, within established business cases, such as the printing of lumbar spinal fusion cages using titanium alloys, there has been significant market uptake from a huge number of device OEMs in both internal production and outsourced contract manufacturing. Secondly, and equally important, has been efforts to demonstrate the viability of new business cases for the use of AM to produce devices. In some cases, these cases have been ‘validated’ previously, but now with much wider competitive support and global presence, they have become a more universally recognized business case across the industry.

We would call particular attention to a couple of potentially very interesting market examples in the expansion of the business cases for additive orthopedic implants which could significantly push the overall industry forward.

The first is in the emerging sector of additively produced off-the-shelf shoulder arthroplasty systems with components produced via metal additive technologies. At least two leading innovators in the world of AM implants have are preparing full market availability of such devices this year, to include Lima Corporate’s SMR TT Hybrid Glenoid, and ExacTech’s Equinoxe Stemless Shoulder systems. These devices address the fastest growing segment of the shoulder arthroplasty market, which in itself is expected to under exceptionally rapid growth as an underserved joint replacement opportunity in the future. These systems feature titanium printed cage glenoid structures with known porous printed features for biologic fixation, drawing on existing market acceptance of similar structures applied across spine, hip, and knee segments over the last several years.

Second, is the continued establishment of patient-matched knee solutions with directly printed implant components. Although there are existing solutions from BodyCAD and ConforMIS that have utilized 3D printed surgical guides and casting molds, at least one company in Italy known as Rejoint is now preparing for full availability of a directly printed implant system drawn from patient imaging data.

Finally, although first announced almost two years prior from today, American company SI-Bone has demonstrated how additive manufacturing can also be successfully clinically applied to specialty areas of orthopedics with its iFude3D sacroiliac joint stabilization implant. The device somewhat mimics printed spinal cages in appearance and design but is tailored to addressing sacroiliac dysfunction in the pelvic region.

Overall, the building of new business cases is critical for the expansion of AM in the world of orthopedics, as is the continued acceptance of otherwise proven business cases among a wider swath of device companies over time. For more insights on the current state of additive manufacturing technologies in the orthopedic industry,

SmarTech Analysis has just released its latest study on additive orthopedics, available for order.