The market for additive manufacturing in the general and commercial aerospace industry has undergone several radical changes over the past three years, all targeted toward implementing the AM process in part manufacturing. Although following very different dynamics, these changes concern both the metal AM and the polymer AM (metal replacement and composite) segments. Most of the new evolutions in the AM market indicate a continued and sustained growth in the adoption of metal 3D printing systems, along with rapid technological evolutions primarily on three major fronts: speed, size and process automation. The number of hardware system suppliers has increased dramatically; the number of adopters for end-use part production is also now increasing more rapidly. AM for civil aviation is now closer to serial part production for both polymers and metals. While actual serial production by AM is still limited in size, several processes have been implemented to industrialize, understand and optimize the process.

Opportunities for Automotive Additive Manufacturing 2018-2023

Automotive industry stakeholders worldwide are now racing toward full industrialization and integration of the AM process within their end-to-end production workflow, beginning with software and materials, passing through the AM hardware, and ending with services and a growing number of possible applications. 3D printing is thus well positioned to expand its use as the primary technology for automotive prototyping as well as tooling, while also establishing a stronger than ever opportunity for serial and mass customized part production.

We expect the overall market for AM in automotive to grow to an impressive $12.4 billion US by 2028 (growing at 24.8% CAGR). This growth will be driven in the short and medium term by increasing adoption and use of 3D printing for prototyping and tooling.

Opportunities for Additive Manufacturing in Ceramics 2018-2023

Few materials in the world of manufacturing offer as wide a range of applications as ceramics. When it comes to additive manufacturing, the wide range of ceramic applications and material types is further expanded by the even wider range of different ceramics additive manufacturing processes that have been—and are continuously— researched, validated and implemented in ceramic manufacturing. Ceramics additive manufacturing has been studied for close to two decades (almost as long as AM has existed) and while it has shown great promise from the very beginning only very recently have the first real, practical and commercial applications of ceramics 3D printing begun to emerge.

With all digital AM processes for ceramic production, indeed as with all traditional ceramics production, the printed parts must undergo considerable postprocessing before reaching their desired mechanical and chemical properties and final-part density. In essence, photopolymerization processes first require debinding in order to remove the polymer, and then all technologies require the parts to be sintered — unless, of course, you’re printing sand molds and cores for metal casting.

Opportunities for Additive Manufacturing in Dental 2018-2023

No other year in the history of the dental industry has seen as great a push towards global adoption of digital dentistry than 2017 and, as a result of this, attention from dental professionals on 3D printing technologies is at an all-time high. This, of course, is a net positive for the dental 3D printing industry, which remains one of the key vertical markets for 3D printing solutions by stakeholders developing such products. However, with the great push to digitize workflows and fabrication processes, the dental industry overall remains in a great state of change, one that 3D printing technologies may ultimately capitalize on for future growth opportunities, but also one in which the path forward is not clear.

Certainly, 3D printing technologies as a whole are now firmly planted in the spotlight of the dental industry as it collectively seeks to integrate cutting-edge technologies. Total revenues for dental 3D printing including revenues associated with service-based printing by laboratories and specialist production centers reached $2.5B in 2018, up from $1.8B in 2017. The global dental 3D printing market is estimated to have generated around $750M in 2018 in dental AM hardware, material, and software sales.

Medical Additive Manufacturing Opportunities 2018-2023

We continue to identify the application of 3D printing technology to medical treatments as one of the biggest technological innovations in healthcare over the next thirty years. In particular, SmarTech Publishing is active in quantifying medical 3D printing market opportunities in the shorter term, through the coming decade. During this period, 3DP is likely to see adoption for medical treatment purposes, and such applications are expected to drive a significant portion of the global 3DP market opportunity.

The total aggregated medical 3D printing opportunities are expected to reach $4 billion in total by 2023, growing from just over $1.5 billion at the end of 2018. SmarTech Publishing takes a market-based approach to creating forecasting and market data tracking models in 3D printing rather than attempting to model the entire cross-market industry size with a single approach. However, with a current market size of over $1.5 billion in total opportunities, medical related 3D printing is likely to account for nearly 15 percent of the total 3D printing industry today.

Additive Manufacturing Opportunities In Metals 2018-2023

Even though metal AM has been booming, total revenues reported in 2015 have been revised down from our previous study. This may seem counter-intuitive but is actually due to greater than anticipated activity from major metal powder suppliers and their sales activity with major end users. This activity, characterized by much larger average order quantities and significant volume discounts, resulted in lower than previously expected average pricing in a number of critical alloys. Mid-term outlook for metal powder revenues is now estimated at $1.4B by 2023, growing from $300M in 2018. Longer term outlooks remain largely unchanged thanks to stronger than previously expected overall utilization and acceptance of metal AM systems, with total revenues expected to climb to $2.1B in 2025 compared to previous estimations of $2.36. The metal AM powder market is forecasted to reach $3.1B by 2027.

Additive Manufacturing Opportunities in Oil & Gas 2018-2023

The Oil & Gas industry is poised to become one of the most important generators of revenue – both near and long-term — for additive system manufacturers and service providers worldwide. We believe that AM will be invaluable to oil and gas industry stakeholders as well as to the investment community, while it will offer a huge opportunity of growth to the additive manufacturing

community itself.

The overall market for AM adoption in the Oil & Gas sector is expected to grow at 40% CAGR throughout the full 11-year forecast period between 2016 and 2027, which is taken into consideration in the full report. Growth rates are higher in the first part of the forecast and they slowdown in the second half of the forecast period, as the segment consolidates and yet continues to explore a very significant potential. Overall, SmarTech Publishing expects 3D printing hardware and 3D printing services to represent the most significant revenue opportunities, with AM software (not including CAD) only representing a minor revenue opportunity at this time.

Additive Manufacturing Opportunities in Oil & Gas 2018-2023

Additive Manufacturing Opportunities in Polymers 2018-2023

We foresee a continuously and rapidly expanding market opportunity for the supply of plastics, polymers, and thermoplastic composite print materials. When accounting for low-cost printers utilized in professional environments, this market has grown from an estimated $670 million worldwide in 2014, to nearly $1.1 billion by the end of 2017. We are now forecasting that the overall market for polymer materials in AM will grow to just over $4.2 billion by 2023, driven primarily by vat photopolymers and thermoplastic powders for PBF technologies.

Are Refractory Metals Additive Manufacturing’s Next Hot Opportunity?

If you were to ask anybody about metal 3D printing technology, chances are today that a lot of people would actually know what you were talking about. Metal additive manufacturing has grown significantly in awareness over the last decade, after all. If you were to find somebody who knew a little bit about the current technology, they’d probably talk about printed titanium implants, or cobalt chrome aircraft fuel nozzles, or maybe even injection molding tools made of tool steel. These are the big metals-based areas of printing today (sure, there’s more than just these), and each have broken onto the industrial scene over time and continue to grow today.

But what about the fringe areas of metal additive manufacturing? It seems like everybody knows about printed titanium and titanium is always one of the early-entry targets for new business efforts in metal AM. Consider HP’s new Metal Jet technology announced at IMTS earlier this month –the original launch material set will center around stainless steel, with titanium being the likely target for its first venture into new materials after the widely popular steel segment.

Refractory metals are a class of metals which are extraordinary in properties, and simultaneously infamous for being difficult to work with. The most common use of refractory metals is in alloying with steels, nickel, and cobalt materials to create many popular super alloys – several of which are widely used in additive manufacturing today. But to process refractory-based materials, which utilize one of several metals as the primary element in their composition, there is relatively little global activity despite the potential for significant demand. Materials like tungsten are combined with other elements to create carbides, making them easier to process on a wider scale while retaining incredible properties.

Because all refractory materials are ultimately processed from some form of powder, additive manufacturing has been explored as a potential means to directly create finished components from refractory metal-based materials. The latest study from SmarTech Publishing explores these early opportunities in an effort to answer the question – could additive manufacturing processes expand the ability to use refractory metals in a more meaningful fashion to serve the most demanding applications in aerospace, medical, energy, and industry beyond what is currently capable?

Answering this question poses another – are refractory metals perhaps the next fast-growing metals opportunity in AM, similar to titanium and nickel alloys of the last few years?

The realities are that refractory metal additive manufacturing holds real promise, and that current commercial activities and efforts likely exceed what most stakeholders are aware of today. However, there is a need for ongoing process development to expand the abilities of various metal AM processes in fabricating refractory pure metals and alloys. Unlocking this potential is a key development goal of several entities across the value chain, from various materials producers, to system manufacturers, to refractory metal processing and components producers and even end users of refractory metal parts.

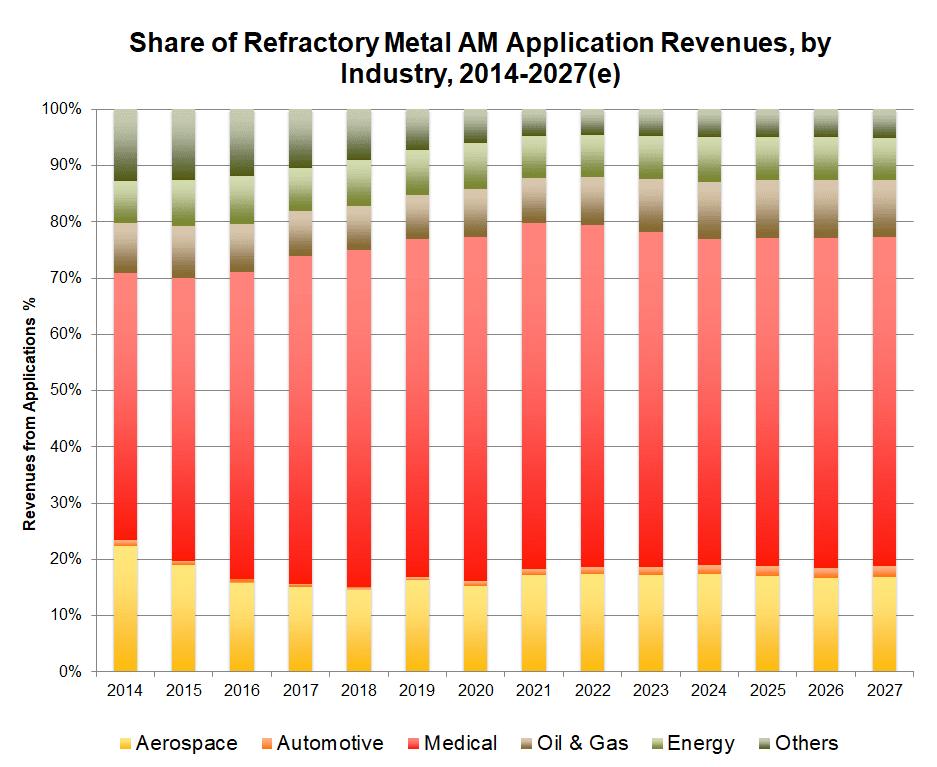

Through the next ten years, SmarTech Publishing believes that refractory metals will be the fastest growing class of metals in powder-based additive manufacturing markets, exceeding even that of aluminum alloys and other specialty materials, growing at a combined 46 percent compounded annually in terms of the consumption of refractory based materials. At this stage in the market’s development, medical applications are expected to dominate the use of AM to produce refractory metal finished parts, though a wide swath of other potential applications exist which will require dedicated solution development.

Source: SmarTech Publishing