Metal additive manufacturing continues to be one of the most influential next-generation technologies. While metal 3D printing is a hot topic in the industry, most of the focus has been on large-scale production and throughput rather than accessibility. For those new to metal 3D printing, entering into additive versus subtractive manufacturing can be a daunting…..

Continue readingFive Footwear Industry Leaders That Use 3D Printing for Production Today: AM is clearly the way to go at adidas, Nike, New Balance, Reebok and Under Armor

Footwear 3D printing is set to grow into a 6.3 billion overall revenue opportunity over the next 10 years (according to the latest report from SmarTech Analysis). If this consumer product segment will deliver what many are now quite convinced it will, most of the credit will likely go to five major footwear AM companies…..

Continue readingSteels – the Unsung Hero Material of Metal Additive Manufacturing

By Scott Dunham Vice President of Research, SmarTech Analysis It’s no surprise that when the media publishes information on 3D printing or additive manufacturing technologies, what attracts the most attention are the extremes –extreme applications, ideas, and, yes, materials. You can read all about the latest cutting edge activity on printing of metallic glass, gold…..

Continue readingSorting Through the Hype of Compact Industrial Metal AM Printers

As I put together my upcoming report on compact industrial metal printers, I can’t help but wonder why some of the competitive low-cost options on the market have been completely overshadowed by Desktop Metal and, to some degree, Markforged. Companies such as Aurora Labs, OR Laser and Pollen AM have had “desktop-like” metal solutions on…..

Continue readingDental Industry Consolidation and 3D Printing – What it Means for Laboratories

The consolidation of dental laboratories and dental practices alike has been one of the biggest multi-year trends in dental care worldwide over the past several years. An integral component on the laboratory side of this trend has been the adoption of digital processes which have put pressure on the classical dental technician artisanship using analog…..

Continue readingHow the Clear Dental Aligner Market Could Change Dental 3D Printing Forever

Clear dental aligners, like those marketed by Align Technologies under the Invisalign brand, have grown by leaps and bounds over the last several years. The vast, overwhelming majority of these devices are produced via a combination of 3D printing and traditional thermoforming, and are perhaps the single highest volume application for 3D printing technologies in…..

Continue readingCompact Industrial Metal AM Printers Are the True “Desktop” Metal Printers

Let’s talk about industrial ‘desktop’ 3D printers, especially as they pertain to metals. Until recently, the metal ‘desktop’ 3D printing market was relatively non-existent, with ‘desktop’ printers being only suitable for polymers. That is until the eponymous Desktop Metal boldly entered the market by high-jacking the term and using it as their company name. It’s…..

Continue readingFive Reasons Why Companies Are Turning to Service Bureaus

Additive manufacturing of metal is popular, but some end user companies are reticent about in-house printing of metals parts. This is, we believe, a powerful factor creating opportunities for metal AM service bureaus. This article defines five factors that have some service bureaus planning for a doubling the number of metal machines this year (2019) according to SmarTech.

#1 Metals Printing Can be Trouble

In the future service bureaus are likely to lose business to in-house 3D printer deployments for polymer printing, but their metals business may increase. Additive manufacturing with polymers is more user-friendly than metals printing making the capital and expertise easier for end users to move the process in-house. There are more process parameters and knowledge involved with metal printing. And, on the materials side, new metals may require special techniques and expertise that are not easily or quickly achieved in-house. This “tribal” knowledge will help service bureaus keep their competitive advantage longer as metal AM becomes more cost-effective and user-friendly.

Metal 3D printers will reduce in cost in the next few years – we have already seen how this could happen from the latest HP and Desktop Metal products. Nonetheless, SmarTech Analysis believes that the combination service provider knowledge, supply chain efficiencies, and high-capital cost will keep metal service bureaus competitive for the foreseeable future.

#2 The “Hot Topic Effect”

The current high level of publicity being afforded to metal printing automatically enhances the prospects for metal service bureaus. Hot topics are, by definition, of immediate importance, but they tend to cool down relatively quickly. It is to be expected that metal additive manufacturing will eventually become less hot as it matures and becomes just another process in the engineering toolbox. Yet, less attention doesn’t necessarily mean that market growth would stop, just that investors’ enthusiasm might shrink.

#3 Lack of User Capital and Low ROI

A classic driver for companies to not 3D print in-house is that some companies just don’t have the capital. The impact of this market driver in metal AM is likely to intensify in the future as more end user firms find they have a need for metal AM but cannot justify the capex.

Service bureaus also offer a way for companies to dip their toes in the AM metals business without having to invest heavily in the equipment, expertise, or time associated with bringing the process in-house. Some companies may even have the capital, but due to fluctuations and volumes the return on investment (ROI) of in-house metal AM is too low to make it viable. Offering metal 3D printing won’t tie down a service bureau, and a company can test the market to verify a parts value before investing the capital to move production in-house.

#4 Size, Complexity and Service Bureaus

Service bureaus may be able to handle large and complex parts more effectively and efficiently than in-house printing can. Being able to process large parts will give a service bureau additional value. Bringing metal printing in-house is already difficult enough, adding larger more expensive equipment adds complexity.

Finally, understanding different materials, process capabilities, and how complex features can change a design will be the experience service bureaus should have that will prevent or delay companies from moving in-house. Simple design concepts, post processing, and even part orientation can help produce a better product.

#5 Industry Focus Helps

Expertise in a particular industry provides competitive advantage for service bureaus. It enables a service bureau to better understand its customers and for both customers and service bureaus to interact in a more effective way. As a result, some service bureaus are specializing in customers from the aerospace industry or the medical sector. Specialized automotive service bureaus are also expected to appear in the near future.

These comments apply to polymer AM as well as metals AM, but we note that specialist aerospace and automotive bureaus both have a strong metals orientation. Metals service bureaus that understand the needs, operations and traditions of big metal-using industry sectors are in a better position to win customers than those who don’t.

For more on the topic of AM metals service providers see “Metal 3D Printing Services: Service Revenues, Printer Purchases, and Materials Consumption – 2018-2027,” one of SmarTech’s latest reports. Metal 3D printing is disrupting multiple industries and service providers with a focus on metals will have the opportunities to take advantage of the technology.

Another Hat in the Ring: Will Xerox Shake up the 3D Printing Market?

At Xerox’s recent Investor Day 2019, a company that has been indirectly involved in the 3D printing industry for many years, announced its acquisition of metal additive manufacturing systems company Vader Systems and the company’s plans to develop a direct role in the market for 3D printing technologies.

Is Xerox entering 3D printing in this way, at this time, like a big fish leaping into a small, yet crowded pond? In the last two years, there are quite a few big fish which have jumped into the proverbial 3D printing ‘pond,’ and while said pond keeps getting bigger, it’s certainly becoming more and more crowded.

Statements from Xerox regarding their plans for 3D printing are very reminiscent of other major companies which have done the same in recent years, with the most direct comparison likely to be HP.

Will Xerox shake up the 3D printing market?

The company’s biggest and most direct influence for now appears will occur via its acquisition of Vader Systems. Vader, in SmarTech’s opinion, is an “aging startup” and a developer of what is claimed to be an innovative metal additive manufacturing technology based at some level on inkjet technology. While Xerox has also made some claims on its intent to bring solutions into the polymer 3D printing market including materials, printing systems, and software, we do not have concrete details as of now so we will focus on Vader and metal additive manufacturing.

What impact might Xerox have on metal AM?

From a technical perspective, Xerox’s acquisition makes some sense. The company has a longstanding history in inkjet technology, and has been a long time supplier of various elements of this technology to other 3D printer manufacturers who use it in their own printers. Vader’s technology is based on some of the same tenants of inkjet printing, with the inherent (theoretical) scalability that comes with it. With that in mind, a lot of my thoughts on how to answer the question of “will Xerox shake up the metal additive manufacturing market” end up circling back to “what are the reasonable expectations for inkjet-oriented technologies to compete against fusion or extrusion based technologies?”

There’s no easy way to answer or opine on that in a blog post, but for now, I’ve made a few observations and formed some opinions that have started to shape my thoughts on Xerox’s potential impact (keeping in mind that more concrete details are still to come).

First, the primary statements regarding Xerox’s own motives for the Vader acquisition (and apparently it’s overall upcoming 3D printing activities that will be revealed in more detail), are based on the perception that, “manufacturing customers want to use 3D printing, but the current offerings only serve the prototyping market well, not broad manufacturing.”

I consider this a very risky statement to put forth as the bases for a large investment and business strategy as this this perception is becoming rapidly outdated. I would argue that manufacturing customers are using current 3D printing technologies and they want to use them more as they are able to overcome production challenges. Suppliers and customers are increasingly messaging parts production in their AM efforts.

Xerox is also staking its position in metal AM on a technology that is decidedly not impacting the broader AM market as of yet. While there is an argument to be made for going with an outsider whose technology matches up closely with your own expertise, at this time I believe that the manufacturing community at large is ready to buy into a specific metal AM manufacturing process and work at fine tuning their processes and technologies to advance. To this end, technologies like powder bed fusion, and metal binder jetting have exponentially greater support in terms of end-to-end solutions.

There also comes a point where switching and experimenting with other metal AM methods provides diminishing returns for manufacturing customers. Xerox will have to sell the most influential users of metal AM today on a new process and at a time when we’re seeing such strong momentum behind some of the existing and more widely adopted methods.

While for now I retain a healthy amount of skepticism about Xerox’ potential success in metal additive manufacturing. I look forward to learning more about the specific solutions Xerox will bring in 2019 and beyond.

By Scott Dunham – Vice President, SmarTech Publishing

The Rebirth of Additive Manufacturing in 2019

As of the end of 2018, it has now been seven years since SmarTech Publishing believes the additive manufacturing (AM) industry reached its most significant inflection point when the mass influx of low-cost desktop machines catalyzed public attention in the technology like never before. Shortly thereafter, in 2013 and 2014, the two largest publicly traded companies in the industry achieved growth levels in both revenues and stock value which further bolstered the world’s interest in AM. During this seven-year span, however, the industry has been challenged like no other period in its history. With collective expectations raised, a similar elevation of the challenges in meeting new found demand has no doubt been a factor in the industry growth over the last few years.

One of the most interesting dynamics during this period has been the ways in which industry activity and attention have made rapid shifts in an effort to capitalize on the significant (but potentially fleeting) surge in interest in AM. Afterall, a failure to meet the demands of customers ultimately results in a lack of customers to do business with, and as expectations and goals leapfrogged capabilities and reality over the last seven years, a number of sizeable or innovative companies have made significant moves in order to build new business foundations that seek to establish a hold in an industry going through a rapid and tumultuous rebirth.

Metal additive manufacturing, while historically much more niche in overall adoption and use than that of polymer 3D printing, seemed to quickly bypass the polymer segment in terms of delivering on the promise of a manufacturing revolution over the last seven years. This has resulted in major structural shifts in the industry which continue to play out in current days. Major industry trade shows have steadily grown to impressive events by any measure, but with more and more emphasis positioned on the latest in metal additive manufacturing technology and solutions. Companies like Desktop Metal, Markforged, Digital Alloys, and other start-ups have far outpaced fundraising based on their metal AM solutions than those in the polymer space since 2016. Leading players previously only positioned in polymer 3D printing have announced major strategic shifts to introduce metals solutions for 2019 and beyond, including Stratasys and HP.

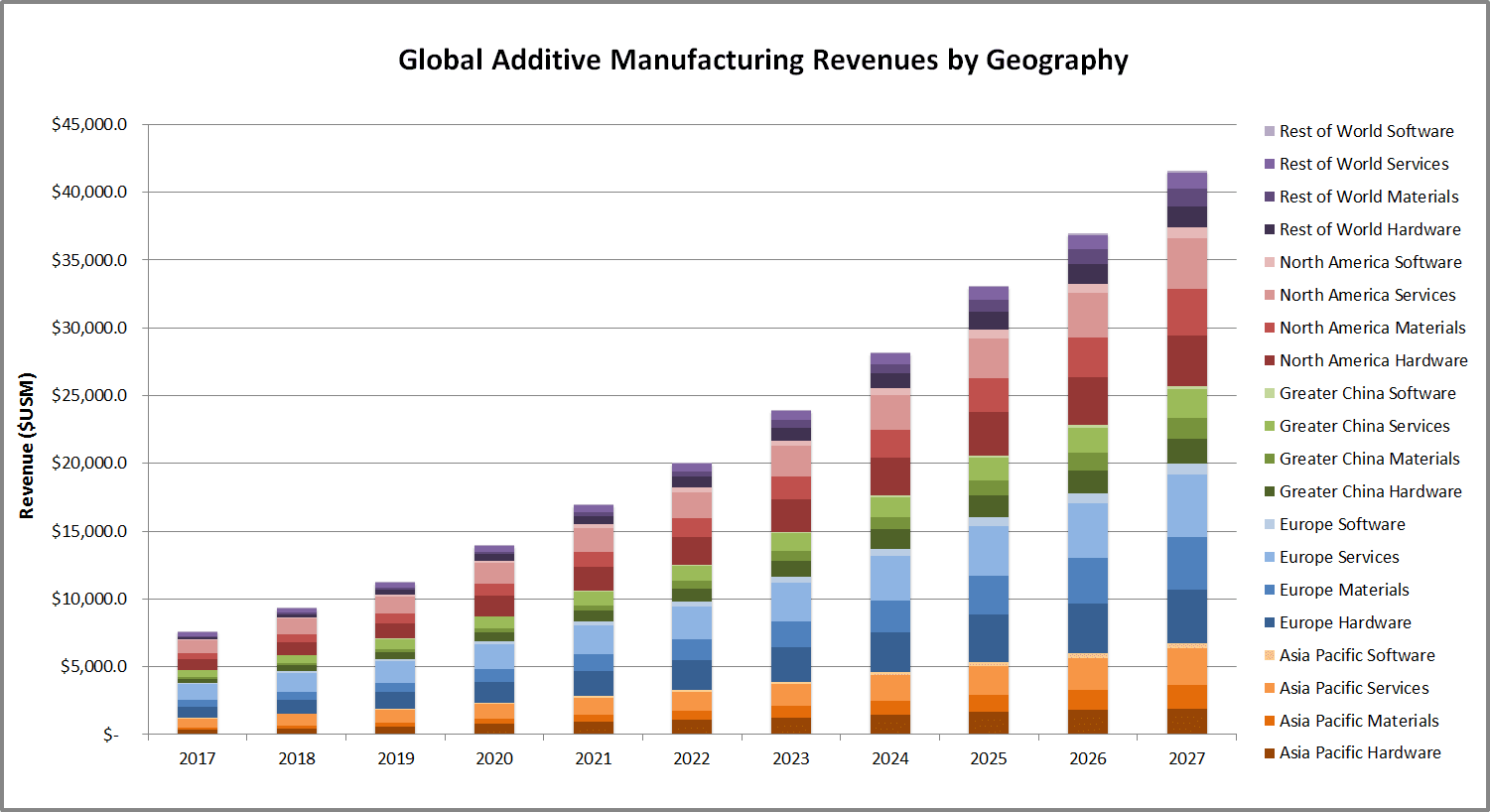

Source: SmarTech Publishing, Additive Manufacturing in 2018 – Review of Key Opportunities

Indeed, over the last seven years, additive manufacturing has been in a state of hectic, uneasy growth. Out of balance, and uncertain, the AM industry could be likened to a race car driver who, in the pursuit of speed and ultimate victory, temporarily loses control of his vehicle for a period of precarious instability—still moving forward, but without the balance and control that guarantees the driver finishes the race at all. In 2018 things appear to be changing yet again. A restoring of balance appears to be forming, with major players beginning to overcome growth challenges little by little towards sustainable progress. This can be credited in part to two developments. First, the influx of multinational entities with considerable resources have joined in the industry in more direct, meaningful, and ultimately supportive ways to help stabilize the path towards meaningful, controlled progress. Global chemical manufacturers the likes of BASF, Evonik, Covestro, Solvay, and many more have begun to take ownership of moving technologies (especially plastics and polymer solutions) more seriously towards becoming tools for manufacturing. Meanwhile, large manufacturing tool and technology companies like Trumpf, DMG Mori, HP, GE, and many more have lent considerable development and supply chain resources to the industry to improve the level of access, consistency, quality, and other aspects required for a maturing technology to succeed.

Second, a massive industry refocus on application-driven solutions has helped focus development efforts and shed negative perceptions of legacy rapid prototyping technologies when targeting more serious manufacturing-oriented engagements. All leading technology companies are now dedicating resources to building machines and solutions with a specific, high value end user in mind, rather than generalized or half hazard strategies in the attempt to make their machines the single go-to solution for every customer type. While the ultimate end goal of the industry may indeed be to take opportunities currently captured by other manufacturing technologies and processes (like CNC machining or injection molding) and convert them to additive ones, the growth driver of the current industry is creating solutions for existing manufacturing problems where other tools and processes struggle to deliver, and creating growth that is complementary—not competitive—to existing manufacturing processes.

Looking ahead to 2019, SmarTech Publishing believes the AM industry will be reborn. Not only does overall industry growth appear to be gaining its pace again with historical levels, but it appears the entirety of the industry stands to make sizable gains in unison, and as a collective rather than in a contrasted group of winners and losers. This is the essence of a true rebirth—becoming whole again, and with a focus on collective and consistent progress.