For the past half dozen years, additive manufacturing (AM) has presented itself to the world as an elite technology suited to grace the pages of Wired magazine, be actively discussed at Davos as part of any homage to Industrie 4.0 and helping to create impressive multi-color models displayed to great effect at trade shows of various kinds.

There is, however, another face of AM; more rugged and better deserving of the name “manufacturing.” It has less to do with printing and modeling and has more in common with coating and welding. There are several such processes, but most have marginal market impact or are proprietary. The exception is Directed Energy Deposition (DED).

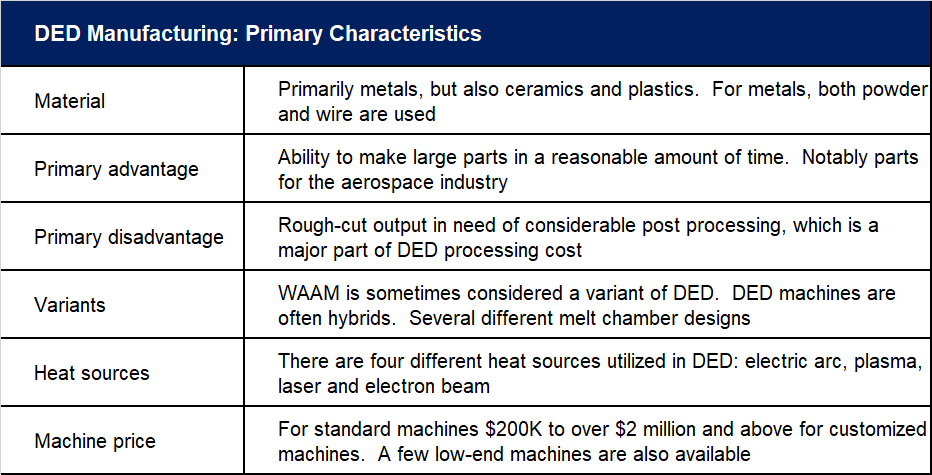

A typical DED machine consists of a nozzle mounted on a multi-axis arm, which deposits melted material onto a surface, where it solidifies. By controlling the motion of the heat source and material feed, the melt pool is directed (hence the name of the process) through a path where it eventually freezes into solid metal. Four different heat sources are commonly utilized in DED: electric arc, plasma, laser and electron beam.

On DED Market Size

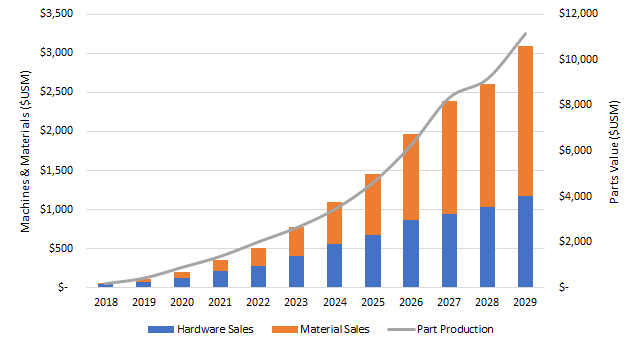

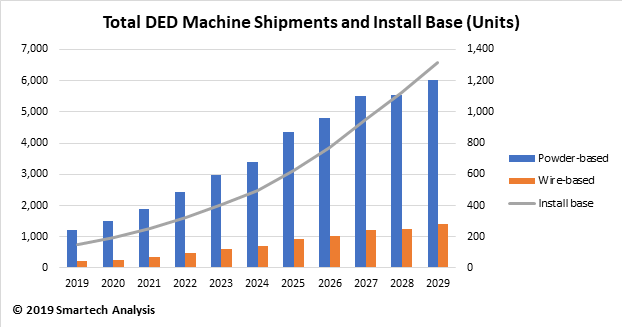

In a recent market study, Market Opportunities for Directed Energy Deposition Manufacturing SmarTech Analysis projects that the market for DED is about to take off reaching almost $490 million for the machines alone by 2025, with that year also seeing $265 million in materials being consumed by DED machines. There are about 740 DED machines installed worldwide at the present time, with that number growing dramatically to 6,590 by 2029.

These high numbers are obscured by the fact that DED is referred to by other names such as Laser Engineered Net Shaping (LENS), Direct Metal Deposition (DMD), Electron Beam Additive Manufacturing (EBAM), etc. These names vary from company to company and enable a company to distinguish itself in the market, rather than admit to being another of the herd.

Repair and Feature Enhancement as Drivers for DED

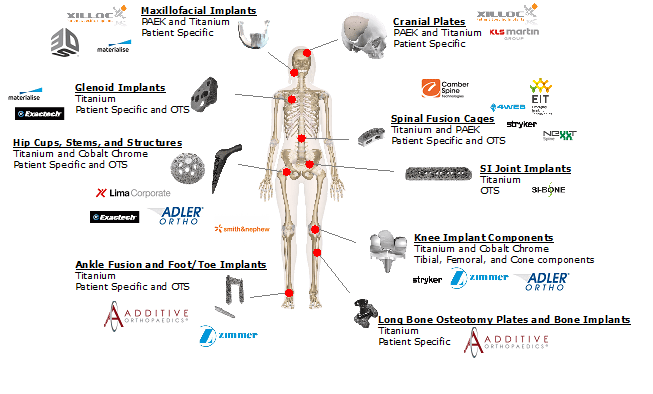

As far as which industries use – or will use – DED, it is the usual suspects – aerospace, automotive, medical, oil & gas, etc. The use of DED makes sense in specific applications where high-speed, low-resolution AM needing extensive post processing is acceptable. As a result of this, the applications for DED might be considered dull compared with the jet engines and artificial limbs that one associates with PBF machines. Often DED applications present as repairs or feature enhancements. According to one source, parts repaired with DED can actually have enhanced material properties so they are better than when first built.

DED can in fact be looked at as a way to automate the manual welding process that has been used for 100 years. DED forms a metallurgical bond like welding but with an extremely small heat-affected zone. This, SmarTech believes, is a major market opportunity for DED, because there is a huge addressable market for DED in the higher end of the welding market. The materials used for DED today are mostly just off-the-shelf welding materials, which helps lower the cost of DED materials compared to materials for other AM processes.

DED is already fairly widely used to repair military equipment. For example, the US Army Anniston depot has used DED to repair engine components for the M1 Abrams tank. This allowed the Army to repair rather than replace worn engine components saving over $5 million per year. DED has also been used extensively to repair turbine blades, satellites and other high-end equipment. Often this repair process is done by defense contractors or by companies working directly for other large industrial companies. As an aside, the connection to the defense industry is supposedly one reason that DED is not as well-known as it might be. Because it may be seen as a military process, it is not as well “advertised” as other processes.

This does not mean that every little metal shop is a prospect for selling a DED machine to. This is clearly not the case. However, for larger welding operations, buying (say) a $250,000 machine that yields better control and repeatability in manufacturing may be an attractive option. More recently, advances in multi-axis robotics and advanced CAD/CAM have allowed more complex shapes to be built onto surfaces. Feature addition can be valuable if the printed feature is expensive to produce conventionally.

Vendors Galore

The ubiquity of repair applications is good news for the future of DED and SmarTech is also impressed by the list of DED vendors: 3D Hybrid Solutions, Additec, BeAM, DM3D, DMG Mori, ELB-Schliff, Evobeam, FormAlloy, Hybrid Manufacturing Technologies, InssTek, Mazak, Norsk Titanium, Okuma, Optomec, Okuma, OR Laser, Prima Additive, Prodways, Sciaky, Trumpf, and Lincoln Electric.

This is a list which includes both major CNC firms and AM firms. In some contexts it is possible that DED is cutting into the market of PBF machine makers.

Fear the living DED.