In 3D printing, its common to get big news weekly. At least, that’s been the trend the past eight years (as long as I have been in this industry). Probably the biggest recent news in 3D printing was the latest funding round closed by Carbon, in which $260M was pledged by various big-name groups, bringing the company’s total fundraising since its inception to a reported $680M+.

This poses several questions which perhaps could be best summarized by a broader one –is Carbon really a startup anymore? Should it now be considered one of 3D printing’s heavyweights, alongside much larger, more historied competitors such as 3D Systems, HP, Stratasys, and the like?

Why the Money?

In order to put some context behind Carbon’s excellent fundraising performance, it’s important to understand the reasons that this business might attract big money.

-

- As a company, Carbon has crafted a catchy, compelling brand and message all the way from its beginning. It’s very easy to see how big investors might be wowed. Carbon seems to inherently know the things to say, and what to highlight, in order to secure the dollars.

-

- Beyond talk and branding, SmarTech believes that Carbon is sitting on something special. Carbon’s value proposition is often conveyed in a way that is meant to be cool, catchy, an in tropes that are becoming a bit tiresome in the industry (10x faster speeds!). But the reality is that Carbon’s technology platform and its business model really are setting Carbon apart from the rest of the industry.

In particular, we think that investors aren’t getting a full picture of Carbon if they don’t understand the role that Digital Light Synthesis (Carbon’s slickly named printing process) might play in the broader world of polymeric 3D printing, and even broader plastics manufacturing.

-

- Such “high speed” or “layerless” photopolymerization technologies are perhaps the most interesting thing to happen to plastic 3D printing since, well, the invention of the traditional photopolymerization printing technologies, which were the first true 3D printing technologies.

-

- Carbon isn’t the only firm to offer this type of technology for a 3D printing platform – at some level, 3D Systems and EnvisionTEC also offer a similar process being leveraged in different ways and with relatively minor mechanical differences. Newcomers like Nexa3D and Origin also have relatively similar printing capabilities but aren’t as far along in establishing a serious 3D printing business as the other firms mentioned above.

-

- At their core, these processes utilize a projector and some form of curing inhibitor mechanics to eliminate the layer-by-layer printing dynamic. What sets Carbon apart today, however, is its control of the printing mechanics combined with a mastery of the chemistry required to create optimized printing materials for big-time applications.

-

- Layerless photopolymerization does appear to be positioned to be potentially competitive with injection molding to a serious degree, especially if it is supported by material development, competent software to manage the complexities of a digital production process, and sufficient customer support. Through this lens, Carbon is probably the most advanced of its peers, but it still has some ways to go.

So, it makes sense for investors to put money into this technology. There are a huge number of players in plastic 3D printing attempt to advance the technology into the territory of injection molding, but Carbon is one of the furthest ahead in terms of taking business from molding technologies.

Carbon: A 3D Printing Heavyweight?

Carbon isn’t yet a 3D printing heavyweight, and this should not come as a shock to anyone, especially its investors:

-

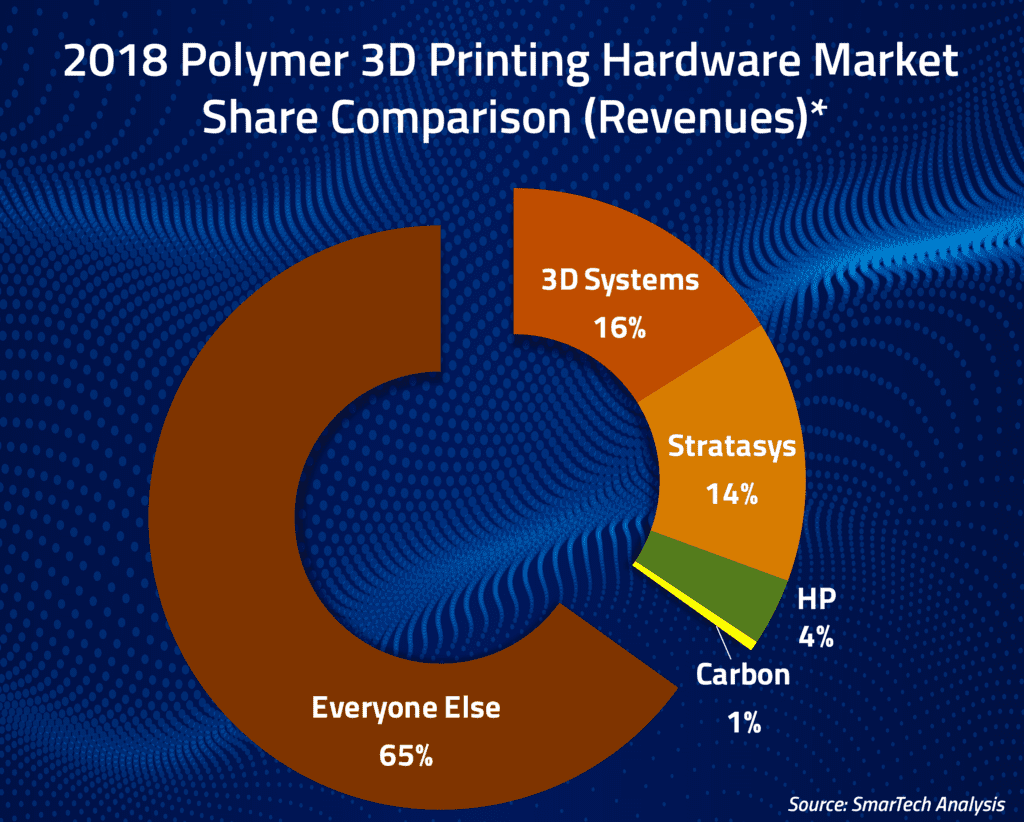

- Compared to 3D Systems, Carbon doesn’t have near the product portfolio (to say nothing of its global network of resellers and parts printing service partners), or the expertise in high impact markets like healthcare. However, here I would champion Carbon’s abilities in the consumer goods market, an area in which it has leapfrogged much of its competition. In 2018 3D Systems held a 16% share of the market.

-

- Compared to HP, which is closer to Carbon in terms of breadth of technology portfolio, it goes without saying that Carbon doesn’t have the global manufacturing resources or sales channels of a $50 billion company. Little to compare there. However, Carbon’s recently raised funds are expected to go largely towards an international expansion. HP is pushing its technology into familiar markets for powder based plastic printing, while Carbon is mainly charting new territory for photopolymer-based printing (if you exclude the more recently launched dental business). In 2018 HP owned 4% of the market.

-

- There aren’t many good comparisons between Carbon and Stratasys. Carbon appears to be growing very rapidly after reporting significant increases in printer utilization metrics from its customers over the last year and has told SmarTech to be adding new dental lab customers almost weekly. Stratasys hasn’t been profitable in nearly six years, has been searching for a CEO for over a year, its revenues have been stagnant for four years, and six years ago probably made one of the most grossly over-valued acquisitions in recent tech industry. Still, the company owned a 14% share of the market.

Comparing the company’s revenues in its targeted segment vs the major players shows Carbon to be a very minor player. In 2018 it garnered .6% of a $1.744 billion (USD) market. However, roughly 2/3 of the market exists outside of 3D Systems, Stratasys and HP and each company has their own vulnerabilities.

Heavyweight or not, Carbon has successfully convinced investors that it compares favorably to the AM industry giants in various ways, at least sufficiently for those investors to open wide their checkbooks.

by Scott Dunham

Vice President of Research

SmarTech Analysis

scott@smartechpublishing.com