If you were to ask anybody about metal 3D printing technology, chances are today that a lot of people would actually know what you were talking about. Metal additive manufacturing has grown significantly in awareness over the last decade, after all. If you were to find somebody who knew a little bit about the current technology, they’d probably talk about printed titanium implants, or cobalt chrome aircraft fuel nozzles, or maybe even injection molding tools made of tool steel. These are the big metals-based areas of printing today (sure, there’s more than just these), and each have broken onto the industrial scene over time and continue to grow today.

But what about the fringe areas of metal additive manufacturing? It seems like everybody knows about printed titanium and titanium is always one of the early-entry targets for new business efforts in metal AM. Consider HP’s new Metal Jet technology announced at IMTS earlier this month –the original launch material set will center around stainless steel, with titanium being the likely target for its first venture into new materials after the widely popular steel segment.

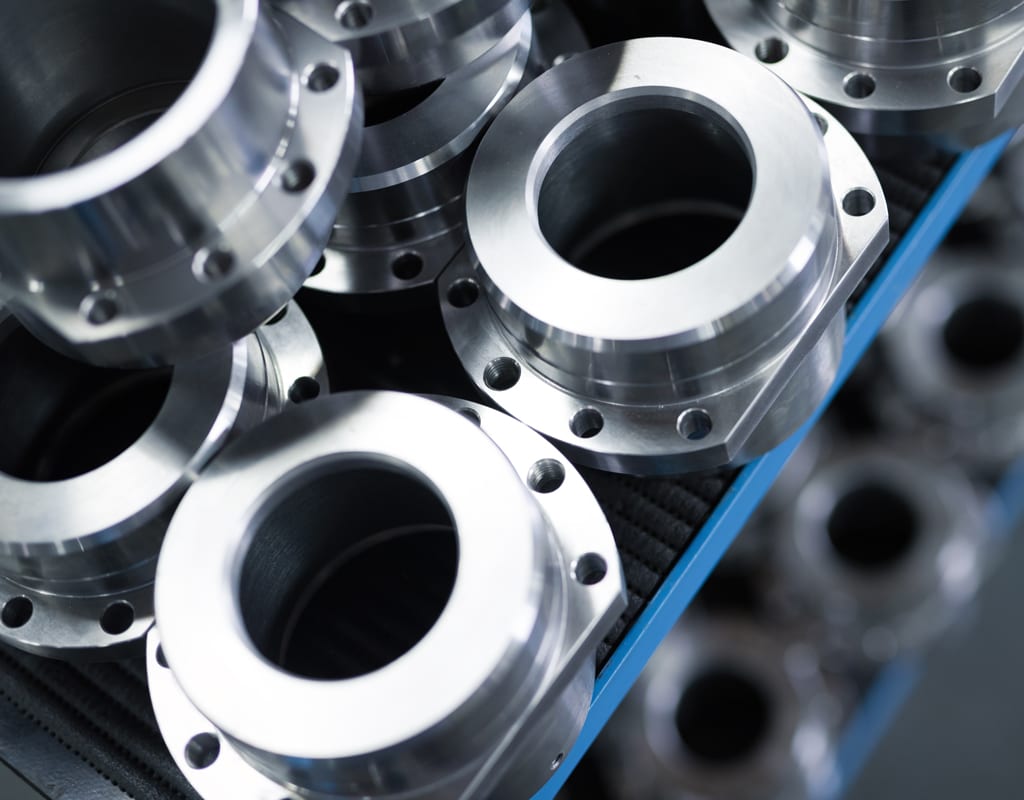

Refractory metals are a class of metals which are extraordinary in properties, and simultaneously infamous for being difficult to work with. The most common use of refractory metals is in alloying with steels, nickel, and cobalt materials to create many popular super alloys – several of which are widely used in additive manufacturing today. But to process refractory-based materials, which utilize one of several metals as the primary element in their composition, there is relatively little global activity despite the potential for significant demand. Materials like tungsten are combined with other elements to create carbides, making them easier to process on a wider scale while retaining incredible properties.

Because all refractory materials are ultimately processed from some form of powder, additive manufacturing has been explored as a potential means to directly create finished components from refractory metal-based materials. The latest study from SmarTech Publishing explores these early opportunities in an effort to answer the question – could additive manufacturing processes expand the ability to use refractory metals in a more meaningful fashion to serve the most demanding applications in aerospace, medical, energy, and industry beyond what is currently capable?

Answering this question poses another – are refractory metals perhaps the next fast-growing metals opportunity in AM, similar to titanium and nickel alloys of the last few years?

The realities are that refractory metal additive manufacturing holds real promise, and that current commercial activities and efforts likely exceed what most stakeholders are aware of today. However, there is a need for ongoing process development to expand the abilities of various metal AM processes in fabricating refractory pure metals and alloys. Unlocking this potential is a key development goal of several entities across the value chain, from various materials producers, to system manufacturers, to refractory metal processing and components producers and even end users of refractory metal parts.

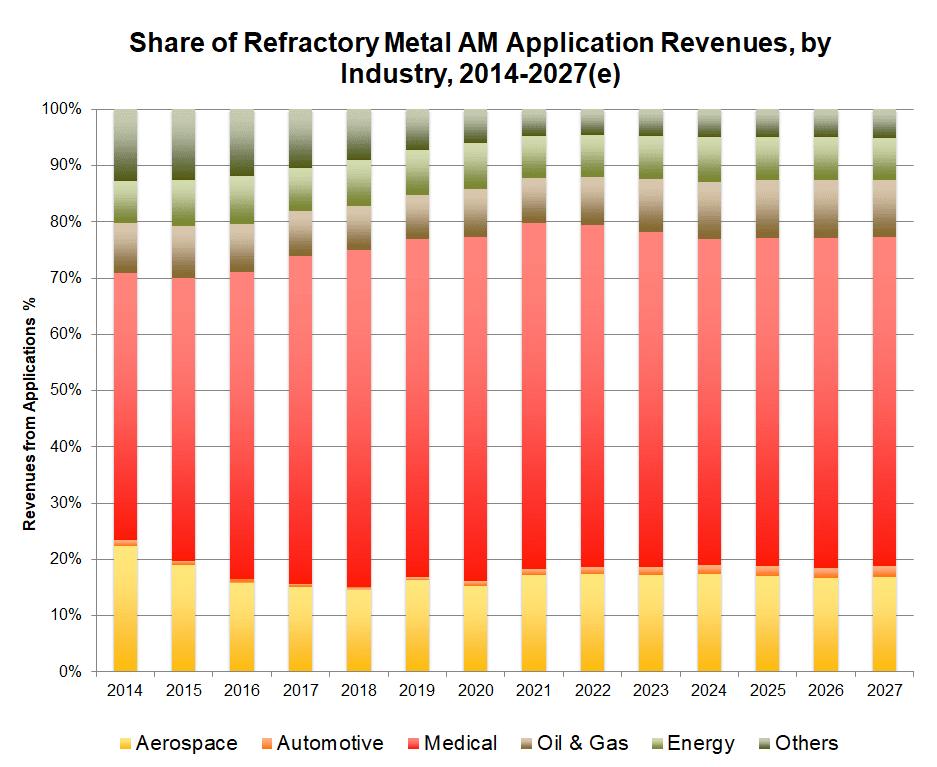

Through the next ten years, SmarTech Publishing believes that refractory metals will be the fastest growing class of metals in powder-based additive manufacturing markets, exceeding even that of aluminum alloys and other specialty materials, growing at a combined 46 percent compounded annually in terms of the consumption of refractory based materials. At this stage in the market’s development, medical applications are expected to dominate the use of AM to produce refractory metal finished parts, though a wide swath of other potential applications exist which will require dedicated solution development.

Source: SmarTech Publishing