3D Printing creating a $2.3 billion software opportunity by 2027

Continue reading3D Printing Software & Realizing the Dream of Advanced Digital Manufacturing

Note from Scott Dunham, Vice President of Additive Manufacturing Research at SmarTech

3D printing technology is often heralded as a digital manufacturing technology. And for some reason, this really gets a lot of people excited. What’s the big deal? 3D printing takes a digitally designed ‘part’ in the form of a converted CAD file, and then makes the part in an automated and computer controlled process. So what? The world has been using computer controlled manufacturing technologies for a long time.

What if I now told you that 3D printing technology is not only a digital manufacturing technology, but it is the digital manufacturing technology. Well, obviously this wouldn’t really be true, for a couple reasons. First off, we just established that digital manufacturing has been in existence and widely utilized for some time. Secondly, a lot of what is 3D printed today doesn’t really qualify under “manufacturing” in the context of fabrication of production parts going into products and systems as a final component.

And yet, I would still stand by that statement -3D printing is indeed the digital manufacturing technology. At least for the future. How? This is where 3D printing software comes in to really expand the idea.

Making a model or a prototype or a final use part using a computer controlled technology isn’t the revolution. The revolution is in applying vastly available digital resources to empower manufacturing. Things like near-infinite cloud computing power. 3D printing is the digital manufacturing technology because physics-based limitations are alleviated, and the ability to actually digitally control the manufacturing process is increased by orders of magnitude, all through the concept of layer-by-layer manufacturing. In fact, don’t think about 3D printing processes like metal powder bed fusion or photopolymerization as ‘building parts,’ think about them as ‘distributing mass in a volume of physical space.’

Software is often referred to as the glue which holds together the hardware and materials in 3D printing. But for the future, not only is it the glue connecting these two other elements, but it will also become the catalyst by which the potential of advanced digital manufacturing can be realized. In our latest report for software for 3D printing, SmarTech explores the current efforts to actualize through 3D printing digital manufacturing software concepts which have existed for nearly a decade or more, but which haven’t yet been able to be fully exploited. Thanks to additive manufacturing, all of that will change.

This is the first in a multi-part series of blogs which lay out how the world of manufacturing will change through a digital manufacturing revolution powered by additive, and catalyzed by software. We aren’t simply talking about designing digitally and then using computers to control a machine to fabricate the design. We’re talking about totally rethinking how parts and products are designed, function, optimized, made, qualified, and certified.

3D Printing Software & Realizing the Dream of Advanced Digital Manufacturing

Q&A With Davide Sher on Automation of Additive Manufacturing

The follwing data points are sourced from the SmarTech report, “MARKETS FOR AUTOMATED 3D PRINTING: 2016 TO 2027: AN OPPORTUNITY ANALYSIS AND TEN-YEAR FORECAST“

What is the role of 3D printers in tomorrow’s automation production lines?

3D Printers are expected to play a key role in the evolution of the digital factory, eventually providing means to further streamline and automate the manufacturing process.

Why is automation becoming a key issue in AM today?

Over the past two years, as 3D printing began to shift from a process used for prototyping and small batch technology to a large batch and mass customization production technology, all major industrial 3D printer OEM’s have begun to pay closer attention to integrating their systems both within 3D printer networks (or “farms”) and within automated production lines.

How much is the overall landscape for industrial automation worth and how much of this will be related to 3D printing?

The overall market for automated factories in the Industry 4.0 is expected to grow from $182 billion in 2016 to $352 billion in 2024. A very significant portion of this, roughly $45 million by 2024, will be represented by PLM (Product Lifecycle Management) software.

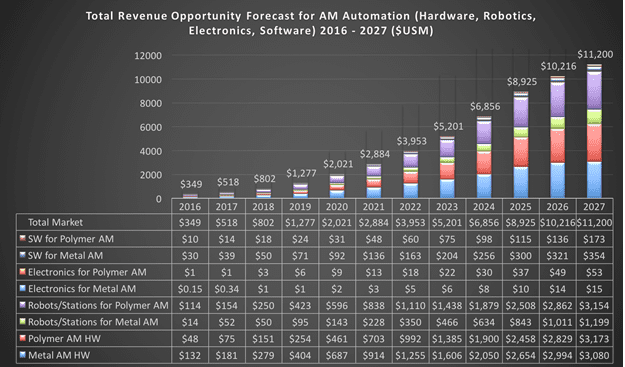

SmarTech Publishing expects the market for automation in AM to represent a very significant revenue opportunity, growing to $11.2 billion by the end of the forecast period at an overall 35.98% CAGR from the 2017 level ($518 million).

How much can 3D printed be further automated and how?

There are three levels at which automation can be implemented in an AM factory or production plant within a complete workflow.

- Process Automation

- Part and Material Handling Automation

- Workflow Automation

Which are some of the key technologies and OEM’s visions for AMA (additive manufacturing automation)?

Several large 3D printer manufacturers have announced and displayed their vision for automating production in an AM based factory. Among those closest to integrating AM into an automated workflow are the large machine tool manufacturers. One of the very first industrial 3D printer OEM’s to devise a vision for automating 3D printing factories is Germany based Concept Laser with its “Factory of the Future” concept. Concept Laser was acquired last year by GE and will continue to build on this concept as its systems are implemented for actual part production within the GE group. Polymer 3D printing market leader Stratasys is working on three different solutions which look toward further automation of FDM (thermoplastic extrusion), its end-use part production 3D printing technology. By comparison, its advanced polyjet technology is seen (and expected to remain for the foreseeable future) primarily a prototyping process.

While photopolymerization has only been considered a production technology for a very limited number and highly specific type of products – such as hearing aids – recent advancements in both technologies and materials have contributed to the technology’s evolution into a full production process, thus increasing the need for automation. Carbon is leading the way with its high-speed CLIP technology infrastructure.

OEM’s Concepts:

- Concept Laser’s Factory of Tomorrow

- EOS NextGenAM

- Additive Industries’ MetalFAB1

- Renishaw’s Automated Workflow

- DMG Mori’s Path of Digitization

- TRUMPF’s Smart Factory

- ExOne’s Exerial Production Systems

- Stratasys Infinity, Continuous Build and Composite Demonstrator Platforms

- Carbon’s SpeedCell

- 3D Systems’ Figure 4

- Formlabs’ FormCell

- Ultimaker’s Bridge Manufacturing

What is the overall outlook for automation of polymer AM hardware?

Sales of automated and automation-ready polymer-based 3D printers are expected to increase significantly over the next ten-year period, driven by widespread adoption of high-speed “planar” technologies, which can achieve printing speeds 10X higher than standard systems. These technologies cover both powder bed fusion (PBF) and photopolymerization processes. The overall market opportunity for automated polymer AM hardware is expected to reach $3.172 billion by 2027 with 45.62% CAGR from 2017. The overall revenue opportunity for automated metal AM hardware is comparable, with yearly sales expected to top $3 billion by 2027, growing at 32.42% CAGR from the current 2017 levels.

What are the other key elements in the AMA workflow?

Since this report focuses primarily on mechanical automation of the AM process, robotic systems play a significant role, both in some of the processes (3D printers are robots as well) and – perhaps more importantly – in the intermediate part handling stages which connect the different stations within the entire production workflow. Automation of material handling is a must for the future of AM as mean of production. Workloads for operators are expected to increase significantly with part size capabilities, as the powder-filled modules can already weigh several hundred kilograms. The post processing phase currently represents one of the most significant bottlenecks in the automation process however it is also undergoing some of the most rapid evolutions in terms of automation, especially in the realm of polymer powder bed fusion based technologies. The automated AM factories of tomorrow are also likely to integrate advanced automated metrology, inspection and 3D vision solutions in the production flow. Due to the high average costs of these systems, they represent a significant revenue opportunity.

What types robotic interactions will take place in tomorrow’s AMA factories?

Companies will, in the future, be concentrating on the collaboration of human and machine, simplified applications, and light-weight robots. Added to this are the two-armed robots, mobile solutions and the integration of robots into existing environments. There will be an increased focus on modular robots and robotic systems, which can be marketed at extremely attractive prices. Robotic units are expected to connect multiple processing stations. These will be either based on multi-axes robotic arms (mainly for extrusion technologies) on rails or autonomous robotic carts (mainly for powder bed technologies).

What is the outlook for metal AMA?

The overall revenue opportunity for automation units in metal AM is expected to near $1.4 billion by the end of the forecast period, growing at 37.37% CAGR for the 10-year period. The overall market for automated stations and robots in polymer AM is expected to top $3.1 billion by the end of the forecast period, growing at 35% CAGR between 2017 and 2027.

What will tomorrow’s AMA factories look like?

The evolution of 3D printing factories within the scope of this report identified structures which are expected to hold a maximum of 20 to 30 systems. In the first half of the forecast period, the great majority of internal AM production departments and AM service bureaus, even those working toward automated batch production, are expected to have less than 10 systems and thus much smaller surfaces to cover for data transmission.

What is the role of software going to be?

In this report SmarTech Publishing is focusing on process and mechanical automation. This means that the software analyzed in this section is used either for running the AM process (and the other related processes that were examined in the previous parts of this report) or the production line. In the world of advanced manufacturing the term MES to describe software based Manufacturing Execution Systems is already fairly common. However, it is only now beginning to be introduced to AM, leading SmarTech Publishing to coin a new acronym: AMES.

What types of software will drive AMA?

Software is an integral part of AM automation, not only for managing the product’s lifecycle but also for establishing a digital factory environment while managing and controlling the actual process and production workflow. SmarTech Publishing’s forecast for automation software in AM covers four main segments.

- Networking

- Simulation

- Process

- Production

What is the overall outlook for software in the AMA workflow?

SmarTech is estimating the overall value of software for metal AM automation forecasting the overall segment to grow to $353 million in yearly revenues by 2027, growing at 25% CAGR from the current 2017 levels. The revenue opportunity for software in polymer AM automation is also expected to represent a very significant and highly profitable opportunity, totaling $172 million in yearly sales by the end of the forecast period, after growing at 29.5% CAGR between 2017 and 2027.

Q&A With Davide Sher on Automation of Additive Manufacturing

Automating 3D Printing

Automating 3D Printing

Industry 4.0 Will Not Occur Without AM Workflow Automation

From Davide Sher,

SmarTech just released my latest AM market report, this time on AM workflow automation, that is automation of the AM production line. In this report, I tried to assess what the overall business volume could attain from the establishment, within tomorrow’s automated factories, of the fully digital production line which use AM as the core production process in an end-to-end production cycle.

For this report, I only considered automation of the mechanical processes involved. In other words that part of digital manufacturing that takes the product from a digital file ready to be 3D printed (so after it underwent CAD, CAE and CAM software processes) and before the distribution and retail phase (which is managed by CRM and ERP software).

While the creation and commercialization processes are well on their way to be fully digitalized in the Industry 4.0 concept, the part which I analyzed and researched in this report is the least digital today. Even with a potentially pure digital process like 3D printing at its core, the manufacturing process is the most labor intensive so it is the primary bottleneck in a more streamlined, efficient and sustainable idea of production.

Within this process exist several different phases and levels where automation could be implemented. In some cases, the means to do it already exist and simply need to be assigned or programmed for specific tasks, in other cases, they still need to be developed. However, in all cases, it appears clear that most 3D printer manufacturers have become aware that – as AM becomes a more efficient mass manufacturing or mass customization platform – the 3D printer is no longer a stand-alone system but needs to be integrated into so-called “production cells” or “end-to-end digital production lines”.

These production lines include several different stations – which can also be integrated into single systems – with automation occurring at three different levels. One is of course software, where MES (Manufacturing Execution Systems) software, such as Materialise Streamics and Authentise, are being optimized for AM. Others take place within the different processes (3D printing, material handling, post-processing, finishing) and in the overall AM workflow automation, with robotic systems and electronics (sensors and networks) acting to connect the different stations.

Every major company is working toward this goal, both in polymer and in metal AM technologies. Some more than others. Concept Laser, for example, has outlined a clear vision for the fully automated factory of tomorrow – which provided a base for my own research in this field. Other metal AM system manufacturers such as Renishaw and Additive Industries have introduced production systems which provide integrated and automated powder sieving and resupply, thermal treatment and even part handling. EOS also provides solutions for both process and workflow automation, while major DED system manufacturers like DMG Mori and Trumpf are simply implementing current machine tool automation practices to the include the metal laser deposition engines.

In polymers, the stated intention form new entries HP and Carbon to target production through high-speed laser technologies has been driving current PBF and photopolymerization market leaders like EOS and 3D Systems to focus more on optimized and automated workflows and new systems. At the same time, established low-cost system manufacturers such like Formlabs (for SLA) Ultimaker, Lulzbot and MakerBot (for filament extrusion) are building automated production cells and networked 3D printer farms which contributed to driving Stratasys to build three different solutions employing robotic arms and multiple 3D printing engines for increased automation and production rates through 3D printing. Many of these automated solutions are run using Siemens software, with the PLM software giant actively partnering with AM companies to further develop automation capabilities in the AM process.

In the report, I began with SmarTech’s extensive and consolidated database of yearly 3D printer sales and estimated the number of systems which are going to be both process and workflow automation ready. My research, which included conducting interviews with some of the major players in this area, enabled me to estimate the size of tomorrow digital, additive, automated factories. I conducted interviews with and gathered information from Concept Laser, Carbon, Desktop Metal, HP, Stratasys, Materialise, Post Process Technologies, Kuka. Using this data, I assessed the number and overall revenues deriving from the robotic and electronic systems which will be necessary to run these factories. Finally, leveraging SmarTech’s AM software sales database and interviews with market leaders and experts like Siemens’ Ulli Klenk and Authentise’s André Wagner among others, I assessed the market for the software that will increasingly be used to run these processes.

Summing up all these factors I expect the market for AM automation to grow from about $500 million today to just over $11 billion ten years from now. The biggest revenue segments will be metal and polymer 3D printers, especially the PBF ones, with robots (for both metal and polymer workflow) also representing a significant share of the market. Software will be a strong driver as well, while the cost of electronics (without including computers and servers) is surprisingly low since the overall numbers of machines and size of the factories is still expected to be far from that of current mass manufacturing.

IoT and Industry 4.0 solutions are being implemented in several segments of industrial manufacturing. By integrating AM into the digital production workflow this level of automation could reach new heights. AM cannot evolve without automation and no factory could ever be fully digital without integrating the full voxelization of matter and products.