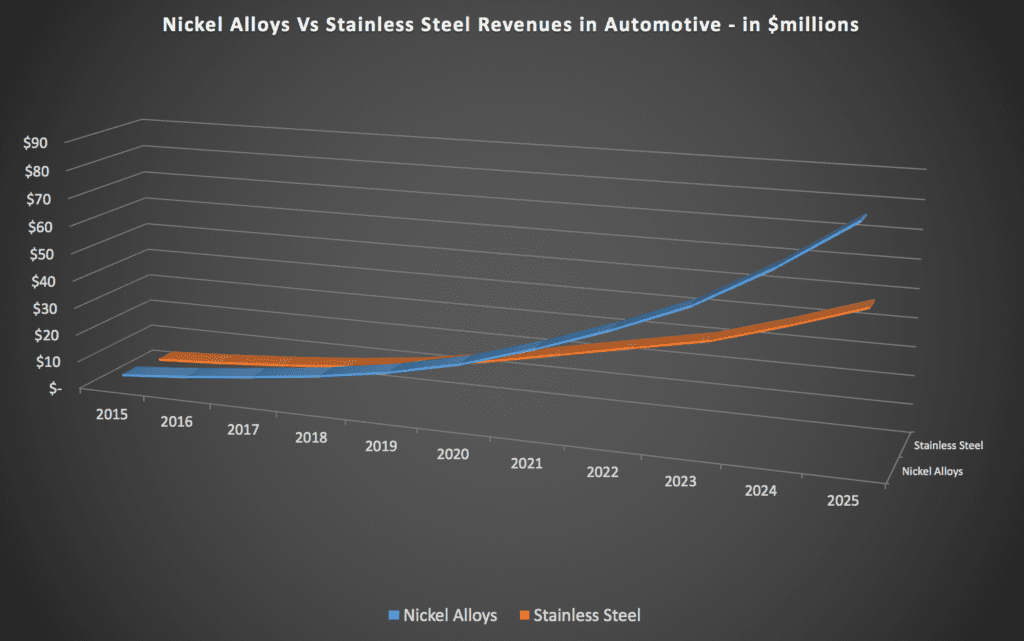

SmarTech Publishing’s The Production Manager’s Guide to 3D Printing with Metals, analyzes several key aspects to consider when implementing metal AM in a company’s workflow. One particularly interesting development that production managers will need to consider is the rise of the Additive Factory. We think that this would bring significant benefits in several industrial areas, especially for round-the-clock manufacturing of parts and components for the automotive and aerospace.

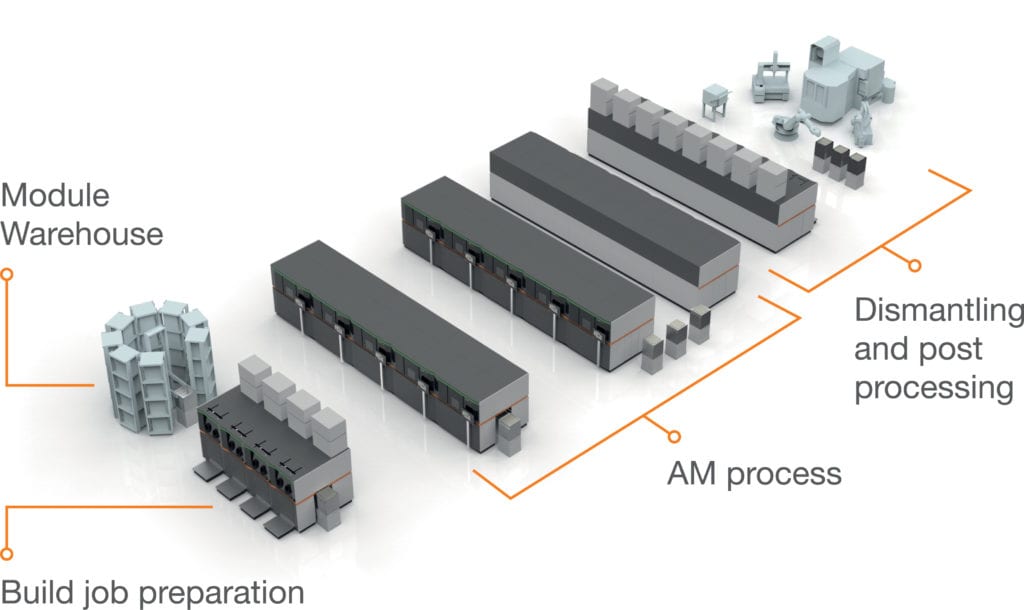

Concept Laser’s vision of the factory of tomorrow puts modular 3D printers together with other modules dedicated to automated process and post-process management

Credits: Concept Laser

We think that the additive factory is both imminent and will exercise a profound effect production dynamics.

Building the Additive Factory

In our Guide to Metal 3D Printing with Metals, we have identified several elements that suggest Additive Factories will become common over the next decade and are something that production managers should be thinking about now.

# 1. Additive Factories already exist. The first additive factories have already been established by GE (Avio Aero in Italy and its plant in Japan with Matsuura technology). Other product agnostic centers with over 20 metal systems for short series production are being built by Lazer Zentrum Nord (Bionic Production) and Citim in Germany.

# 2. Production rates and size capabilities are constantly increasing for all manufacturers. All metal 3D printer manufacturers are eyeing increased productivity and are taking different approaches towards it. Arcam is speeding up production by enabling more powder to come in contact with the electron beam; SLM Solutions already offers a 4 laser system, while EOS has just introduced the new 4 laser version of its EOSINT M400. Concept Laser will also offer a four laser system and has recently introduced the XLine 2000, the largest metal powder bed fusion 3D printer on the market.

# 3. More automated systems are being developed. Metal 3D printer manufacturers are investing considerably in process automation. Concept Laser presents the concept for a fully automated modular factor based on its next generation of 3D printers. Additive Industries has developed a fully automated system capable of 10X production cycles for its vision of “lights off factories”. Renishaw has introduced its idea for an automated process that begins from additive manufacturing of a part that then undergoes further post processing through automated measurement and finishing stations.

# 4. Additively Manufactured parts are now over 99% dense. Additively manufactured metal parts are now, at 99% density or above, mechanically equal or even superior to parts produced by metal die casting. This is true for SLM technologies and even more so for EBM, which can achieve part as dense as 99.9% and above.

What can the Additive Factory do for Production Needs?

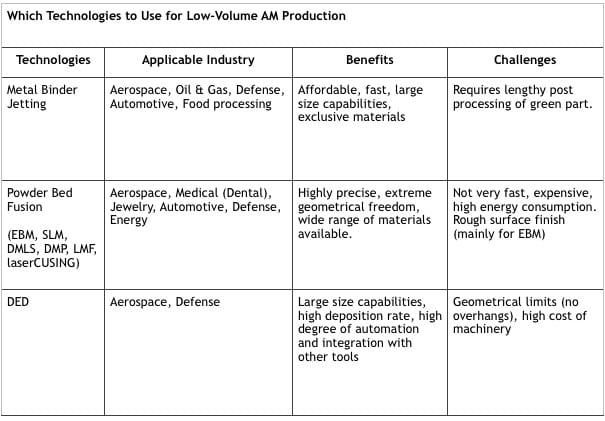

Metal additive manufacturing can be used today for short series production of small, highly complex, end-use, functional parts and components. All currently available major metal 3D printing processes (binder jetting, powder bed fusion and directed energy deposition) can be used to this end, however, each technology offers specific advantages and limitations. In the Exhibit below, we show which additive manufacturing technologies are most appropriate for low volume production – and therefore are most likely to be used in an Additive Factory.

Credits: SmarTech Publishing

The single biggest advantage of using metal AM is the technology’s capability for production of topologically optimized “bionic” structures. These are highly complex shapes, such as trabecular, lattice or fractal structures, which are generatively designed through CAD software. These highly complex shapes can only be reproduced physically through additive manufacturing’s unique geometrical freedom. In fact, in most cases, the more complex a part’s geometry is, the easier that part will be to 3D print. Since AM does not require a mold or a CNC machine tool to reach into the cavities, it can produce the parts, which are designed by CAD calculations and parametric settings, to be up to 90% lighter, without a loss in structural integrity.

Within the additive factory of tomorrow, SmarTech Publishing believes that the most common technology for short series production will remain powder bed fusion. This type of process includes electron beam powder bed fusion (EBM), offered uniquely by Swedish metal 3D printer manufacturer Arcam (currently being acquired by GE), and laser powder bed fusion, generically known as selective laser melting (SLM), which is offered by several system manufacturers.

EBM is ideal for production as it can be used to print stacked parts, thus increasing the production rate. On the other hand, there are many more laser powder bed fusion manufacturers and their combined technologies can already use a wider (virtually limitless) selection of metals. SLM can also be used for short series production, especially in larger size 3D printers. In order to maximize production rates, several SLM 3D printer manufacturers are offering both larger machines and multiple lasers (South Africa based Aerosud’s upcoming system is believed to be able to print parts as wide as two meters). To be exploited to the fullest, higher production rates will require a fully automated process for powder management, build chamber atmosphere control, process management, part cooling and post processing. The promise is that of highly efficient, round the clock, fully digital production of short series, destined to become exponentially larger over time.

About SmarTech Publishing’s 3D Printing with Metals End-User Report

This is a practical guide for the production manager who wants to get up to speed on the state of the art in metals-based additive manufacturing and where it is headed in the future. It is focused specifically on the requirements and practical aspects of implementing metals printing including providing direction on equipment choice, process integration and materials selection. This Guide answers important questions such as:

- Which are the technologies that you should implement?

- Which materials should you use to obtain optimal price/speed/quality ratios?

- Should you use metal 3D printing just for functional prototyping or for short-run production?

- What are the characteristics that make a particular product fit to be 3D printed in metal?

- Which prototypes, tools and parts can already be 3D printed?

The reader of this Guide will discover what each metal AM technology can offer in terms of size, speed, costs, production capabilities and automation. It analyzes each of the most commonly used materials to expose advantages and challenges in their utilization. Finally, it explores both the dominant current and near future applications in which metal AM can offer unrivaled manufacturing advantages.

If interested in purchasing a copy of this report, please email missy@smartechpublishing.com or you can purchase it directly on SmarTech Publishing’s website.

About SmarTech Publishing

SmarTech Publishing has published reports on most of the important revenue opportunities in the 3D printing sector including personal printers, low-volume manufacturing, 3D printing materials, medical/dental applications, aerospace and other promising 3D market segments. Our client roster includes some of the largest 3D printer firms, materials firms and investors in the world.

Since 2014, SmarTech Publishing has published dedicated, in-depth market studies focused on additive manufacturing opportunities in the metals sector.

Press Contact:

Lawrence Gasman

lawrence@smartechpublishing.com

434-872-0450