SmarTech Publishing’s new Additive Manufacturing Opportunities in Oil and Gas Markets report, shows that additive manufacturing (AM) is still at an early stage of adoption in the oil and gas industry, however it also claims that in the near future, all sectors of this industry — upstream, midstream and downstream – is going to benefit from AM.

Oil and gas prices are at record lows and many smaller companies in the industry are struggling, while the larger companies are reported to be considering mergers and drastic staff reductions in order to cut losses and improve gross margins, the latter being the worst they have been in 30 years. In this poor environment SmarTech Publishing believes that AM will prove a very useful tool to cut costs and streamline processes.

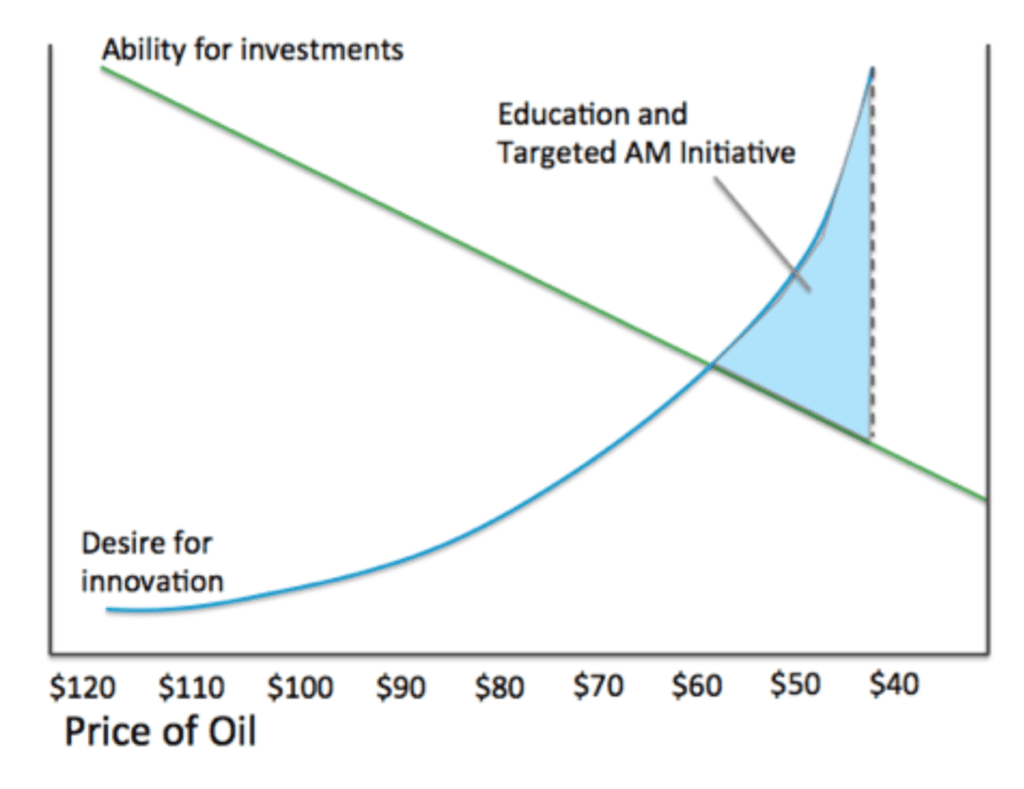

In the past, oil and gas firms have traditionally not invested in advanced manufacturing technologies, even though industry profit margins – around 20% – would have facilitated it. SmarTech Publishing believes it will be harder now to make that transition and that AM may open a new era of prosperity for some firms in oil and gas. But in its report, SmarTech Publishinganticipates that falling energy prices and constricted operations due to relatively inflexible cost structure are catalyzing the desire for innovation.

AM Returning Oil and Gas to Prosperity

GE’s oil and gas division has taken up a leadership role in deploying AM processes presumably learning from its already extensive use of AM in its aerospace manufacturing group. In Italy GE is printing metal end burners for gas turbine combustion chambers as well as nozzles through an automated production line. In India, GE plans to use AM to enable as many as 44,000 fuel nozzles to be manufactured per year. In Japan, GE has been using Mastsuura 3D printing technology to produce control valve parts since early 2015.

While GE is clearly a pioneer in this space, SmarTech Publishing believes that the largest oil and gas giants, the E&P companies, will soon begin to use AM extensively. If energy prices rise again, E&P companies will have an easier time investing in AM. But even if they do not, they may still have no choice but to invest in AM to streamline processes and cut costs.

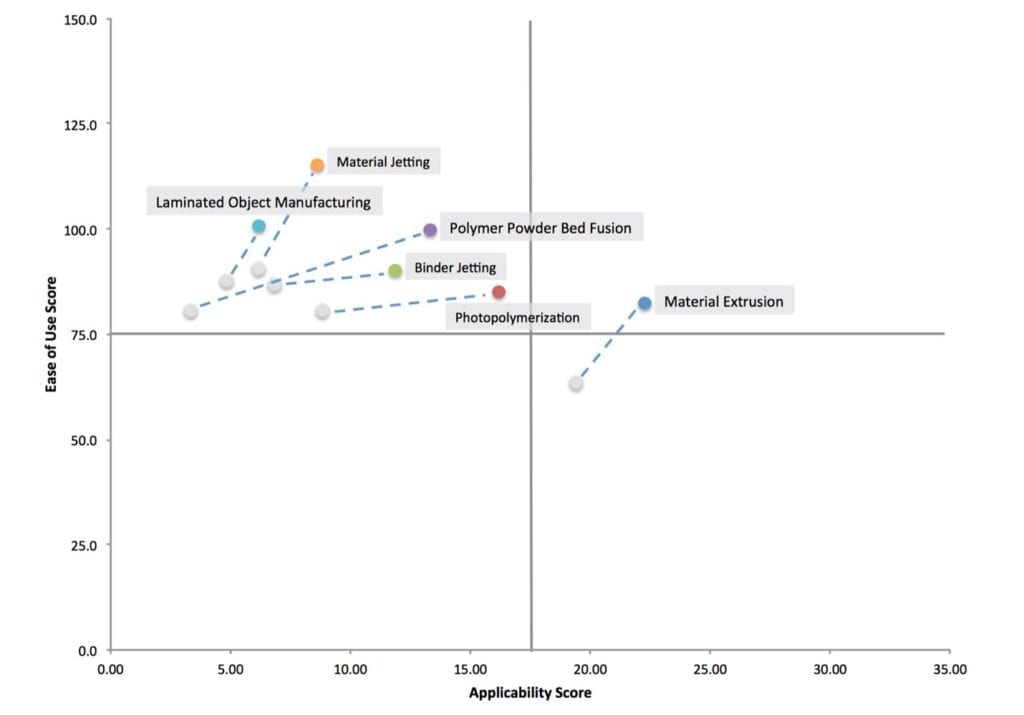

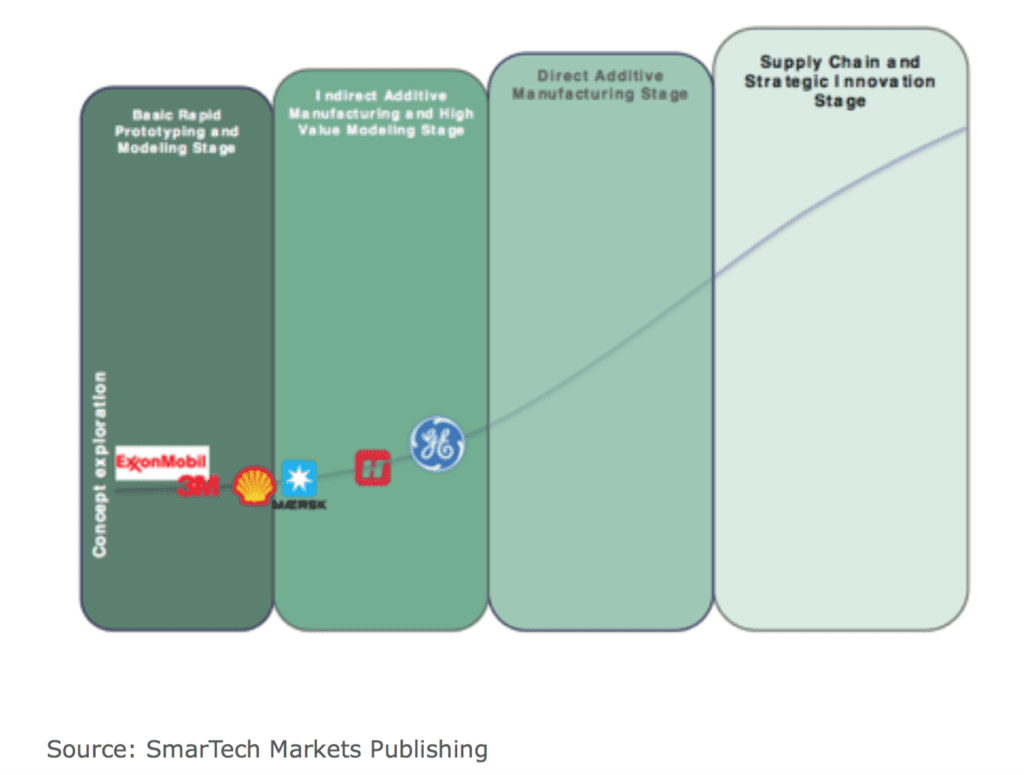

We think that E&P companies will primarily use AM for refining and processing equipment, but also for prototyping and modeling for exploration and operational equipment. Today, however, the oil and gas industry is just beginning with AM adoption. Even the most advanced adopters of AM still live in earlier stages of the SmarTech Publishing AM adoption model. (See Exhibit A.)

Exhibit A – Companies Investing

Although, AM could help return the oil and gas industry to prosperity, the industry is quite conservative, which is one reason why the potential of AM has remained largely unexplored Transocean and OneSubSea, two prominent organizations involved in various aspects of subsea oil and gas operations and services, report that they do not believe there is currently significant implementation or investment into advanced or novel manufacturing technologies in the subsea sector.

Likely AM Strategies for AM

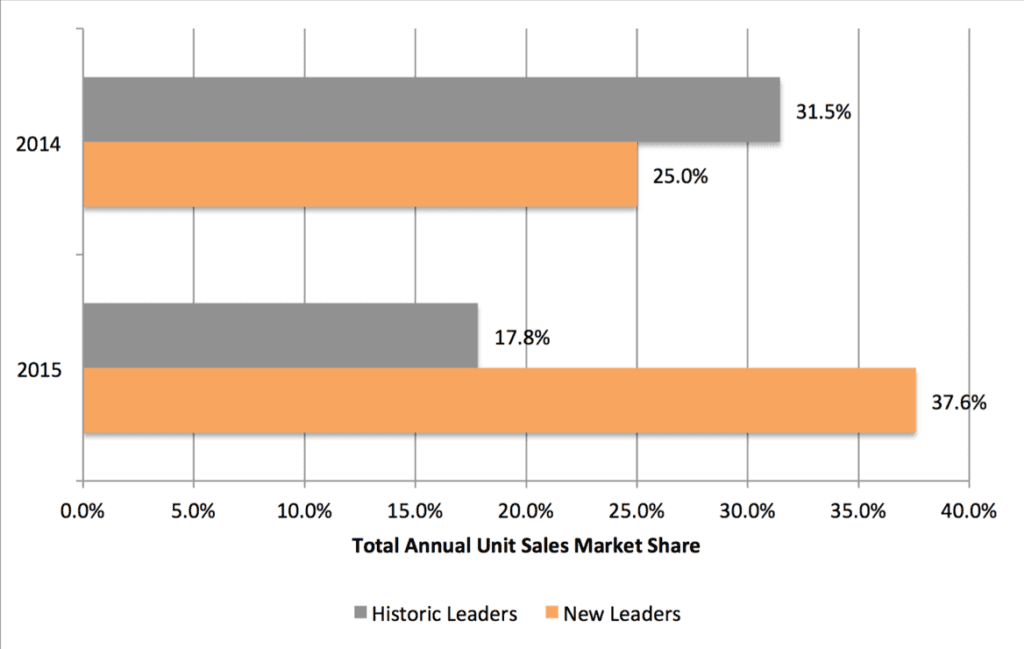

Exhibit B shows SmarTech Publishing innovation trajectory in the oil and gas industry. As we have already noted, we expect the oil and gas industry to learn a lot from what has already been done with AM in the aerospace industry.

These are applications stemming from metal AM, however SmarTech Publishing believes that the Oil & Gas industry also stands to benefit, in the shorter term, from polymer based 3D printing for the production of physical 3D models. Two examples here to indicate how AM can move beyond aping aerospace:

- One E&P giant, Shell, has published a successful case study on this type of application. This covers a polymer 3D printed prototype of the highly complex system that will connect the Floating Production Storage and Offloading (FPSO) vessel of its Stones Project to pipelines from the seabed.

- Similarly, the implementation of multi-material and multi-color 3D printing technologies could prove invaluable for creating physical representations of three dimensional seismic imaging data, enabling exploration professionals to better communicate across business units and between teams, as well as to more accurately gauge well production potential through physical modeling of the geologic features in the area.

Exhibit B – Willingness To Invest

SmarTech Publishing’s new report details many other opportunities for AM in the oil and gas industry. And for the oil and gas industry to fuel the AM industry’s growth, in the most cost-efficient and sustainable way, is bound to be mutually beneficial.